Victoria Jenkins, Managing Director, and Jessica Leong, Lead Casualty Specialty Actuary

Can we learn from Solvency II to unlock the hidden value of reinsurance for long-tail business?

Reinsurance on a long-tail business such as casualty provides lasting capital benefits until the complete run off of the underlying business. It not only reduces underwriting risk, but also the future reserve risk for that book of business. Yet how many companies are properly considering this multi-year capital relief in their reinsurance decision-making? Solvency II’s one-year risk horizon has the potential to draw attention away from the multi-year risk compared to the current Individual Capital Assessment regime. The complexity of creating a comprehensive multi-year capital model means that in our experience many companies are not focusing on the multi-year risk of long-tail business when considering their reinsurance strategy.

Reinsurance strategy decisions are often evaluated by assessing the change in economic value between the current reinsurance program and alternative options. We define the economic value of a strategy as the difference between the expected return and the cost of servicing the risk capital required to support the strategy:

Economic Value = Net Underwriting Profit - (Net Capital Required * Cost of Capital)

The difference between the economic value of the current strategy and an alternative strategy is the economic value add (EVA). A positive EVA can be thought of as an improvement on the current strategy.

Typically, EVA only considers the capital savings over a one-year horizon - that is, the economic value formula looks at the reduction in the required underwriting risk capital over the next year only. For short-tail property classes of business this is often a reasonable assumption, especially for catastrophe business. From an economic capital modeling perspective, as soon as the most recent accident or underwriting year has elapsed the risk transforms from contributing to underwriting risk and drops into the reserve risk bucket until it has completely run off. Therefore, for casualty reinsurance we believe that the economic value calculation should also include the multi-year reduction in future reserve risk that the reinsurance provides. We call this “reserve value add” (RVA). If RVA is ignored, suboptimal strategies could be chosen.

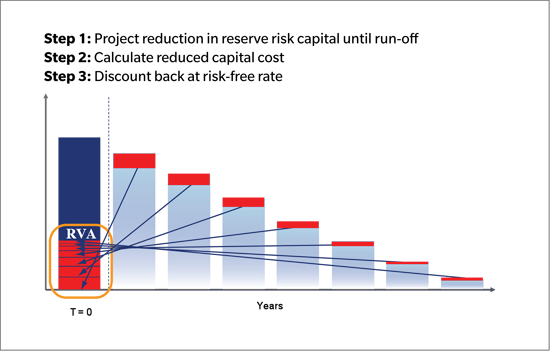

Calculating RVA exactly requires a complex, multi-year capital model and reserve risk model. However, we advocate a simpler approach. While Solvency II can potentially draw attention away from the multi-year view through its one-year horizon, its approach to calculating the risk margin can provide a sound framework for calculating the RVA. This occurs because it measures the cost of the capital required to back a book of liabilities over the entire run-off period. We can use this to determine the savings in capital cost from ceding a portion of the liabilities.

The risk margin calculation is broadly:

- Calculate the solvency capital requirement (SCR) at each future year to represent the capital needed to back the liabilities until run-off

- This capital has a cost of 6 percent above the risk free rate

- Multiply the SCR at each point in time by the cost of capital

- Discount each year’s capital cost back to T=0 at the risk-free rate

- Sum the discounted values

A simplification often used in the risk margin calculation is to assume the capital required at each year-end runs off in line with the payment pattern on the underlying claims. This method can be adapted to provide a straight forward way of assessing the multi-year capital benefit of reinsurance or RVA.

For a single accident year, calculate the reduction in underwriting risk capital provided by the reinsurance at time zero. Assume that this runs off in line with the payment pattern for the losses covered by the reinsurance to reflect the reduction in reserve risk capital over the multi-year period. Calculate the cost of capital saved over all years and discount this back to time zero.

Aficionados of casualty business will recognize the simplifications of this rule of thumb approach. What we’ve looked at above considers just a single accident year of loss as it runs off. The real risk for casualty lines is that multiple accident years tend to deteriorate together. It is important to think about casualty reinsurance as a consistent strategy across multiple accident years rather than a tactical year-on-year decision. Looking at it in this way can reveal greater hidden value that the single accident year approach cannot. But this is a topic for another day.

Reserve deterioration is one of the most common causes of insolvency. Traditional reinsurance programs can reduce this risk right from the start. We conclude that although the RVA method is clearly not perfect it can at least provide a starting point for assessing the multi-year capital benefit of reinsurance. In the words of Eleanor Roosevelt “A little simplification would be the first step towards rational living, I think.“

We would like to thank Andrew Cox for his help in writing this article>

Statements concerning tax, accounting, legal or regulatory matters should be understood to be general observations based solely on our experience as reinsurance brokers and risk consultants, and may not be relied upon as tax, accounting, legal or regulatory advice, which we are not authorized to provide. All such matters should be reviewed with your own qualified advisors in these areas.