Markus Müller, Global Partners & Strategic Advisory EMEA, Capital Optimization

Increased capital efficiency remains at the forefront of (re)insurers' strategies - owing largely to the pending introduction of the Solvency II regime, rating agency capital requirements and the continued pressure around shareholder expectations.

Internal Reinsurance Diversification Benefit

Even though many insurance groups have started to integrate their risk and capital management frameworks, the focus is now shifting - moving towards applying requirements for risk-based capital adequacy to insurance groups rather than to single insurance companies or legal entities, as in the past. One way to harvest the inherent diversification benefits of an optimized capital base is via risk transfer strategies based on internal reinsurance.

Many organizations continue to make reinsurance decisions at the profit center, local entity level or individual underwriting unit level. Often the risk appetite is materially lower at these levels than it is at the group level. This leads to a situation where the group as a whole misses out on taking full advantage of diversification benefits.

The use of an internal reinsurance vehicle (IRV) is one method for bridging the gap between local and group perspectives. Practically, this means the local business units (or profit centers or subsidiaries) cede 100 percent, or a large part of their reinsurance programs to the IRV, which then determines which portion of the program is retained net at the group level and which portion is ceded to reinsurance partners.

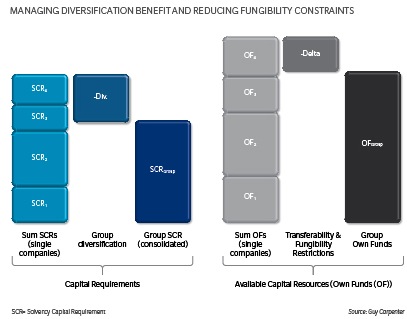

By utilizing an IRV the group is able to take full advantage of the "group leveraging effect" as the benefits of diversification can only be fully recognized at the complete group level. The group becomes able to determine the appropriate level in which to use own capital resources - benefiting from internal diversification - and to determine at which point onwards it is more efficient to benefit from the diversification benefits enjoyed by the reinsurance market instead of deploying its own, more expensive, capital resources. This "group leveraging effect" is also demonstrated by the below chart.

Transferability and Fungibility Options

The transferability and fungibility of capital resources within the group are also important considerations under the Solvency II regime, as only transferable and fungible capital items in excess of the subsidiary's solvency capital requirement can be taken into account at the group level.

What do the terms "transferability" and "fungibility" actually mean?

- Fungibility is achieved when own fund elements in the balance sheet of a single company can fully absorb any kind of losses within the group - fungible capital is not dedicated to a specific purpose.

- Transferability is achieved when the company is able to transfer own fund items from one entity to another within the group.

Under the Solvency II regime funds need to be available to cover the solvency capital requirements within a maximum period of nine months. Examples of own fund items that could lead to fungibility and transferability restrictions on the group balance sheet level are equalization reserves, safety margins in local Generally Accepted Accounting Principles loss reserves, deferred tax assets, expected profits in future premiums and surplus funds in life business. There are other options as well, such as intra-group loans or consolidation of subsidiaries into one legal entity with local branches. However, a relatively simple and efficient method to increase the amount of fungible capital is the use of intra-group reinsurance.

Internal reinsurance can be used as an instrument to transfer all risks onto one balance sheet - that of the IRV. Therefore the group diversification benefit can be captured and managed in a central place while lowering the overall group capital requirements. Furthermore it can serve as a mechanism to increase available capital resources by reducing fungibility and transferability restrictions. Hence internal reinsurance can be a powerful instrument to improve capital adequacy and the cash flow of an insurance group.

Guy Carpenter's Strategic Advisory Team: Capital Optimization Tools and Insight

Guy Carpenter's Strategic Advisory provides clients with comprehensive advisory services in the areas of economic, regulatory and rating agency capital requirements. Solutions may include traditional or structured reinsurance, retrospective solutions for the transfer of risks included in loss reserves or access to the capital markets through our dedicated GC Securities* unit. In EMEA, Guy Carpenter has established a dedicated Capital Optimization team to deliver bespoke reinsurance and capital market solutions to enhance, restore or protect both capital strength and earnings volatility.

As many of our clients centralize their internal reinsurance and reorganize their corporate structure to harvest the benefits of their diversified portfolio, we have developed specific expertise in this area, including: setting up internal reinsurance vehicles, optimizing net group retentions, finding the best group protection and assisting in internal pricing between local companies and the internal reinsurance vehicles including transfer pricing documentation to ensure compliance.

*Securities or investments, as applicable, are offered in the United States through GC Securities, a division of MMC Securities Corp., a US registered broker-dealer and member FINRA/NFA/SIPC. Main Office: 1166 Avenue of the Americas, New York, NY 10036. Phone: (212) 345-5000. Securities or investments, as applicable, are offered in the European Union by GC Securities, a division of MMC Securities (Europe) Ltd. (MMCSEL), which is authorized and regulated by the Financial Conduct Authority, main office 25 The North Colonnade, Canary Wharf, London E14 5HS. Reinsurance products are placed through qualified affiliates of Guy Carpenter & Company, LLC. MMC Securities Corp., MMC Securities (Europe) Ltd. and Guy Carpenter & Company, LLC are affiliates owned by Marsh & McLennan Companies. This communication is not intended as an offer to sell or a solicitation of any offer to buy any security, financial instrument, reinsurance or insurance product. **GC Analytics is a registered mark with the U.S. Patent and Trademark Office.