New capital inflows, excess capacity and few catastrophe losses have contributed to falling reinsurance prices and a challenging environment for specialty insurers and reinsurers. These factors have driven predictions of a forthcoming wave of market consolidation, which appeared to become a reality in late 2014 and 2015 when a series of rumors and announcements related to a number of large (re)insurers grabbed headlines.

While mergers and acquisitions (M&A) transactions were anticipated, a closer examination of recent deals raises questions about whether the driving forces led to expected outcomes. There is a benefit in considering the historic relationship between the (re)insurance pricing cycle and M&A activity, and whether current external forces have led to a shift in this relationship.

M&A Drivers

A casual observer might consider that reduced profit margins and a history of pulsing rate cyclicality mean that today is the time to batten down the hatches and wait for the storm to pass. That conclusion, however, fails to acknowledge the behaviors and economics that drive the insurance cycle. The more accepted notion is that there is a rational anti-correlation between the market's pricing cycle and M&A activity, with soft market conditions leading to heightened M&A activity and valuation multiples.

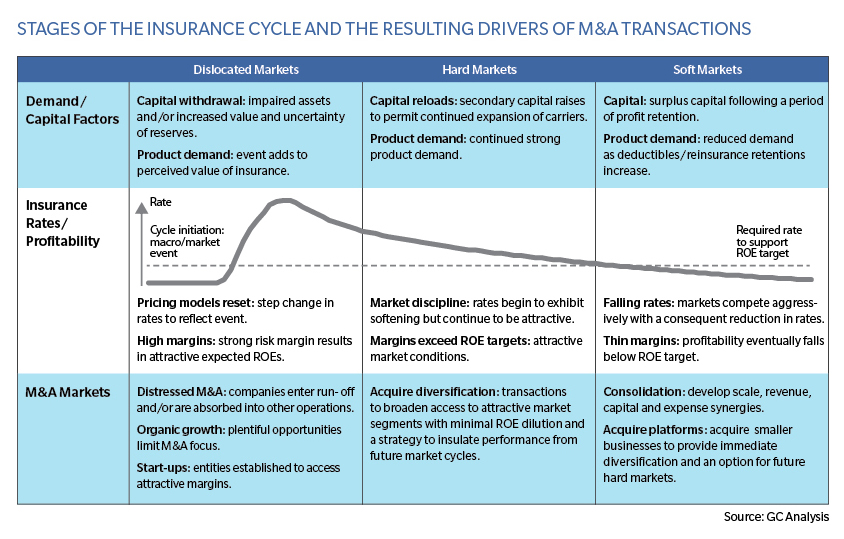

The table below considers in broad terms the stages of the insurance cycle and the resulting drivers of M&A transactions:

In hard markets it is likely that the demand for M&A transactions would be inhibited by the strong inherent profitability of market participants and an ability to continue to access attractive organic growth without the cost and risks associated with acquisitions. A symptom of soft markets is that the lower margin environment substantially challenges a business's ability to maintain returns and deploy surplus capital through organic growth. While a number of strategies are available to rationalize the capital base to reflect these challenges, many businesses are attracted to the alternative routes of deploying capital, and achieving synergies through the acquisition of their peers. The M&A pressures, in turn, may heighten demand for opportunities and drive premium valuations relative to earnings for target companies.