Cory Anger, Global Head of ILS Structuring, GC Securities*

Over the past few years, the capital markets have become increasingly involved in (re)insurance risk. The capital providers have participated in sidecars, catastrophe bonds and more recently in hedge fund-backed reinsurance companies and collateralized reinsurance vehicles. They also have considerable appetite for subordinated debt as they strive for additional yield in today's low interest rate environment. The attractiveness of (re)insurance market risk to the capital markets is clear. They obtain higher yields and the opportunity for diversification into risks that are not completely correlated with financial market risk. The way capital markets access (re)insurance risk is either through investing via specialists funds or setting up their own in-house teams to better understand and analyze (re)insurance risk.

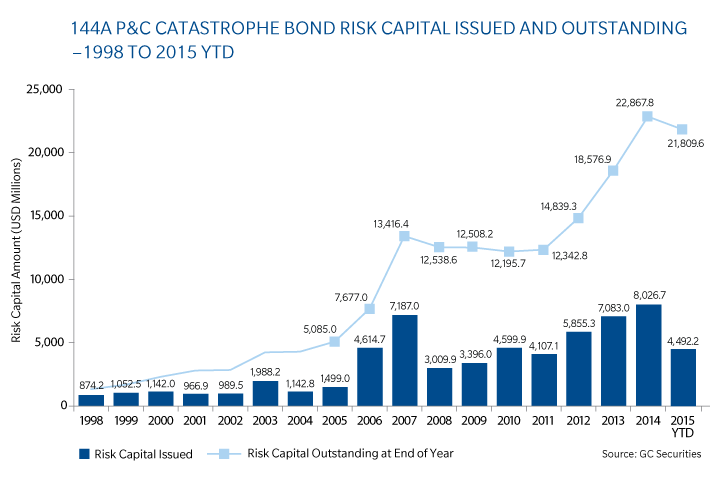

So far, much of the offering from the (re)insurance market to the capital markets has been concentrated on short-term and short-tailed catastrophe risks. Over the past five years, this has been a successful and growing market sector. Therefore, until now, the capital markets' participation has been in a very narrow segment of the (re)insurance market.

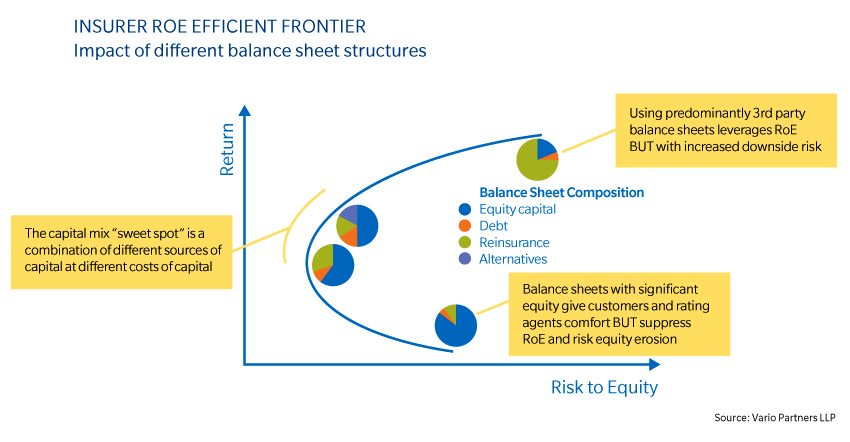

Meanwhile, insurers face a number of challenges brought on by the very low interest rate environment, falling rates across most classes of business and a tidal wave of regulatory scrutiny. They are looking for solutions that would aid them in obtaining an optimal capital structure that mixes equity, debt, traditional reinsurance and insurance-linked securities and allows them to hedge part of their risks in the capital markets and gain the balance sheet efficiency that they obtain when they use the capital markets for catastrophe risks. Indeed, many companies are asking the question: Why can we primarily place only natural peril catastrophe risks into the capital markets?

This question has led to many attempts to find a solution that works for all parties. There has been talk of the development of casualty catastrophe products but this has floundered on the very nature of casualty catastrophes such as asbestos, which takes a long time to emerge and even longer to quantify and settle. There have been structures that tackle single classes of business. For example, the AXA Motor securitizations of 2005 and 2007. The current regulatory and economic environment is leading both investors and insurers to focus on how a market can be made to work in this sector.

So what is needed to develop this market sector for risks beyond property catastrophe and to develop products that will match the needs of investors and insurers? Insurers are looking for capital that is prepared to give them protection and allow them to provide better returns to their equity holders while giving them the assurance that it is compatible with their regulatory framework and provides real protection in times of need.

Investors are looking for instruments where their exposure is defined, trigger events can be clearly identified and difficult to manipulate by management, funds can be returned to them within a finite horizon, yield paid is commensurate with the risk taken and the interests of investors and insurers are aligned. Investors also need to see the data, understand how the trigger points were modeled and replicate or put them through their own models. They also need an independent pricing mechanism that would allow them to mark their bonds to market on at least a weekly basis allowing them to satisfy their investors, despite recognizing that the bonds, at first, would probably be illiquid. The growing use of internal models validated by third parties should provide a crucial missing link between (re)insurers and capital market needs.

The demand for additional regulatory capital and the need for efficient structures are set to continue and both are leading many companies to engage with this market to develop solutions that will tap into the non-catastrophe space. The proposed joint venture between Guy Carpenter and the insurance, non-catastrophe capital markets and risk transfer specialist firm Vario Partners LLP is an early indicator of this trend. It is designed to build solutions to satisfy the needs of insurance companies and investors. We are witnessing the birth of a new asset class demonstrating the dynamism and innovation within the (re)insurance industry.

*Securities or investments, as applicable, are offered in the United States through GC Securities, a division of MMC Securities Corp., a US registered broker-dealer and member FINRA/NFA/SIPC. Main Office: 1166 Avenue of the Americas, New York, NY 10036. Phone: (212) 345-5000. Securities or investments, as applicable, are offered in the European Union by GC Securities, a division of MMC Securities (Europe) Ltd. (MMCSEL), which is authorized and regulated by the Financial Conduct Authority, main office 25 The North Colonnade, Canary Wharf, London E14 5HS. Reinsurance products are placed through qualified affiliates of Guy Carpenter & Company, LLC. MMC Securities Corp., MMC Securities (Europe) Ltd. and Guy Carpenter & Company, LLC are affiliates owned by Marsh & McLennan Companies. This communication is not intended as an offer to sell or a solicitation of any offer to buy any security, financial instrument, reinsurance or insurance product. **GC Analytics is a registered mark with the US Patent and Trademark Office.