In realizing the goal of profitable growth, (re)insurers require a trusted partner to help them manage a rapidly evolving regulatory and rating agency environment.

Catastrophe Modeling

The insurance industry relies to a large extent on catastrophe models to manage catastrophe risk. Regulators and rating agencies recognize this fact by asking companies to justify their modeling approach. The underlying objective of such rules is to encourage companies to have a robust and consistent process to use modeling tools responsibly.

This often entails:

- Understanding the models and their uncertainty

- Validating the tools they adopt and invalidating the ones they choose not to adopt

- Justifying any adjustments and variations made to commercially available models.

A company that is confident in these areas will have an easier time responding to new regulatory submission responsibilities.

Model Suitability Analysis (MSA)®: Catastrophe Model Confidence

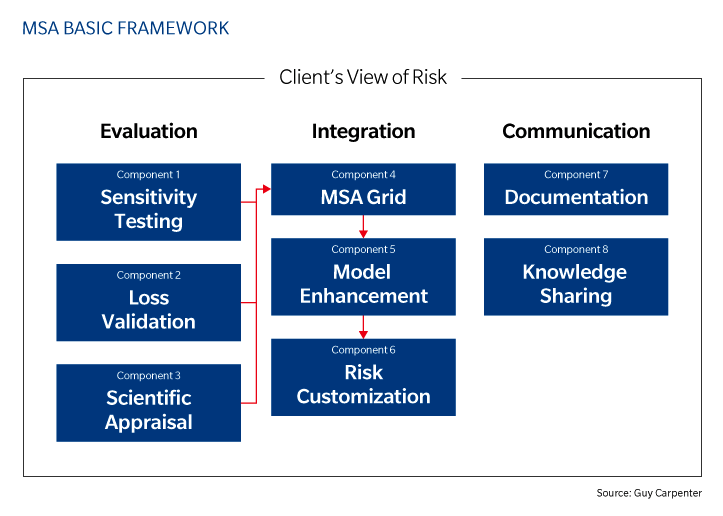

To assist clients in the pursuit of developing a view of risk in which they have confidence, Guy Carpenter introduced the Model Suitability Analysis (MSA) initiative in 2012. The MSA framework consists of eight components arranged across three pillars: evaluation, integration and communication:

MSA Evaluation is driven by rigorously defined tests that cover the three critical areas in which models are investigated:

- Sensitivity Testing - To establish how the model responds to changes in portfolio data

- Loss Validation - To determine whether the model is proficient at reproducing historical claims

- Scientific Appraisal - To benchmark model assumptions against scientific datasets.

MSA Integration is about incorporating Guy Carpenter's MSA knowledge into our clients' operations. Tests are tailored to our clients' risk exposures. Clients may choose to validate their view of risk or to recalibrate their models to a view they believe is more suitable for their company.

MSA Communication consists of establishing a standard recording system for all assumptions and analyses made within the company with regard to model evaluation and adjustments. Through a series of protocols and standard exhibits, MSA helps our clients communicate their understanding of risk with internal as well as with external stakeholders. Clients use MSA documentation for regulatory submissions and for establishing a common view within their corporate family.