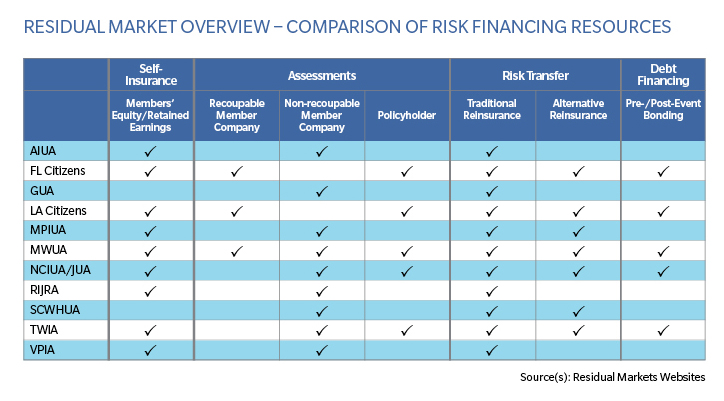

The 2015 reinsurance renewals in this area demonstrated further expansion in the manner and means by which these insurance providers utilize private-sector capital to support their businesses. Traditional reinsurance remains a core component of most residual market risk financing programs. Typically these risk financing plans will also rely on retained profit, assessments and debt facilities in concert with the various forms of reinsurance to manage their exposures. The utilization of alternative risk financing capital through catastrophe bonds and/or collateralized reinsurance continues to grow with eight of 12 facilities that utilize traditional reinsurance also accessing risk transfer capacity through catastrophe bonds and/or collateralized reinsurance to help manage their loss exposures. The chart below details the increasingly diverse set of risk financing approaches employed by 11 coastal markets.

Through their risk financing efforts residual markets are looking to achieve a number of goals. First and foremost to reduce the likelihood of assessments to insurers and policyholders following an event that depletes their claims paying ability. As capital has expanded and providers of this capital have become more comfortable with the exposure and modeling metrics defining the risks, product offerings have expanded as well. When Guy Carpenter works alongside residual market customers, we look to determine the optimal mix of capital sources required to place the risk financing program at the most cost efficient terms possible regardless of source.