Eric Simpson, Managing Director

Maintaining or improving ratings is a priority for most insurers. This can be challenging amid increasing demands for companies to "own their risk" (Own Risk and Solvency Assessment "ORSA") in an environment of evolving rating agency requirements, including A.M. Best's (Best) proposed ratings methodology and Stochastic-based Best's Capital Adequacy Ratio (BCAR) criteria.

The 2016 changes - representing Best's first major methodology overhaul in over 20 years - continue to be refined to incorporate industry feedback and Best's ongoing testing. While these new requirements are not expected to take effect until fall 2017, they are already a key consideration globally for companies that Best rates.

Stochastic BCAR

The proposed BCAR changes have garnered much attention. Best's initial March 2016 draft set the upper threshold for required capital at the 1:1,000-year return time. In May, Best indicated it would reduce the upper threshold to the 1:250-year return time in response to concerns related to the reasonability of model results at the extreme tail for both U.S. and international (re)insurers. In September 2016, Best announced its intention to further temper the catastrophe risk impacts by flowing companies' net probable maximum losses through the BCAR "covariance adjustment" to explicitly recognize their relationship to other risks captured in BCAR.

Despite these recent adjustments, the cost of rating agency capital will undoubtedly increase under the new stochastic-based BCAR model for most "Secure" rated companies (>B++) - particularly those with significant net property catastrophe exposures, common stocks and/or long-tailed underwriting risks.

In response to the announced changes, there have been instances of insurers immediately increasing their reinsurance limits up to the 1:250 year level despite having "passing" BCAR scores under the new methodology. Clearly, any action at this point appears to be premature and misguided, as Best has not yet finalized its criteria.

In contrast, others have taken a more measured approach in advance of their annual planning and 2017 reinsurance renewals. Guy Carpenter is assisting many property/casualty (P&C) insurers to project and interpret their capital positions and risk impacts at the higher return periods for annual capital budgeting purposes using both Best's U.S. P&C and Universal BCAR models. Many catastrophe-exposed companies are using Guy Carpenter's Model Suitability Analysis (MSA)® to determine an objective "management view" of their probable maximum losses up to the 500-year return time. The MSA analysis, combined with Guy Carpenter's BCAR and ratings impact analysis, provides insightful context and guidance for insurers to "own their risk," determine appropriate catastrophe limit protection and align with risk tolerances.

Guy Carpenter is also observing companies analyzing their risk profiles, risk tolerance statements and capital adequacy metrics at higher confidence levels; this goes beyond the traditional 1:100 threshold that was a cornerstone of Best's BCAR model over the past two decades, in response to Stochastic-based BCAR's multiple confidence intervals.

Small/mid-sized insurers are increasingly focusing on developing economic capital modeling capabilities to stochastically measure and manage their "own" risks, and position themselves for more transparent discussions and comparisons of model results with Best in future rating reviews.

Ratings Criteria

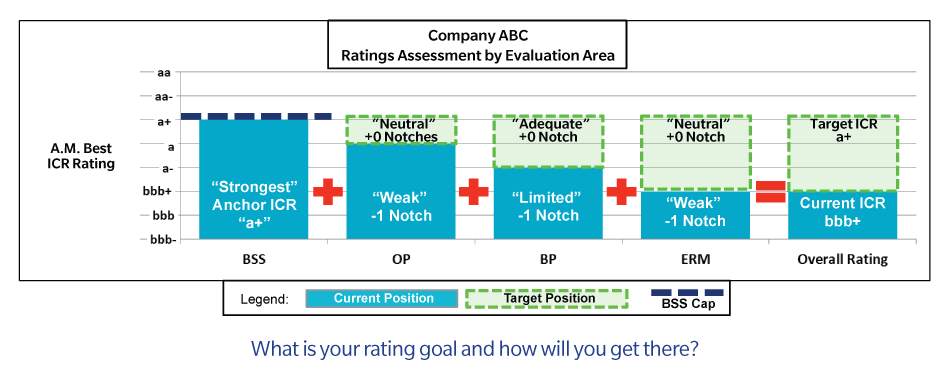

Beyond the BCAR changes, insurers will be challenged by Best's broader ratings criteria changes. The new ratings will facilitate a more transparent road map of how a rating is determined. Best's building block approach allows companies to see how the four core components of the ratings process come together to determine its overall rating. Balance Sheet Strength (BSS) - led by Stochastic-based BCAR - will serve as the "baseline" or starting point for determining a company's rating. A company's Operating Performance (OP), Business Profile (BP) and Enterprise Risk Management (ERM) could provide ratings "lift" or "drag" through notching adjustments to derive the final published rating.

Under its new criteria, BCAR's upside is capped in its contribution to a company's overall rating. In the future, insurers will only be able to qualify for a maximum Issuer Credit Rating (ICR) of "a+" (FSR "A") within Best's balance sheet strength (BSS) assessment based on a favorable result at the 250-year level. Because the maximum ICR rating of "a+" equates to a Financial Strength Rating of "A," companies will need to outperform their peers in the three remaining evaluation areas - Operating Performance, Business Profile and ERM - in order to achieve higher Financial Strength Ratings of A+ or A++. Conversely, companies with sustained under-performance, greater earnings variability, elevated net risk concentrations and lagging development on ERM continue to be most at risk for downward rating pressure.

Many companies have adopted a "wait and see" approach to Best's new ratings criteria and only tweaked their annual ratings presentations in 2016.

Proactive insurers recognize that Best's more transparent criteria and emphasis on strategic risk and capital management warrants immediate attention. Guy Carpenter has already helped companies self-assess their ratings scoring, identify key issues and metrics and develop a roadmap to address material gaps under the proposed criteria. In the process, companies are trying to improve their communications, risk-based analytics and capabilities that align with the relevant rating factors under the proposed criteria. While the final standards and metrics remain fluid, companies are getting started now given the lead-time required to address the relevant issues.

Looking Ahead

ORSA requirements are now in effect. Best's new ratings and BCAR criteria are expected to become effective in 2017. Together, they will accelerate companies' push to better understand and "own their risk" and "own their rating."

Guy Carpenter is uniquely positioned to assist clients with Best's new requirements and provide integrated solutions that improve their performance and ratings over time.