Aidan Pope, Managing Director

Globally, three of the ten most costly natural disaster events in the last 35 years occurred in total or in part in the Latin America/Caribbean (LAC) region (1); losses from Hurricane Matthew in the Caribbean are still being assessed.

Today, 80 percent of the LAC population lives in urban areas, second only to North America (82 percent) and well above the global average of 54 percent (2). The region’s 198 large cities (>200,000 residents) contribute over 60 percent of gross domestic product (GDP), and its ten largest cities produce 50 percent of that total. As the region’s population, swelling middle class, urbanization and GDP concentration continue to grow, the effects of climate volatility will likely increase the impact of natural perils losses on these economies.

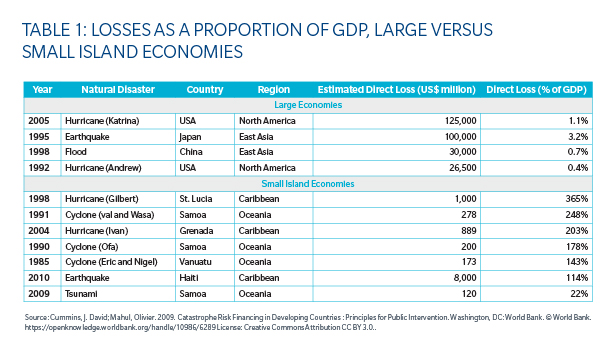

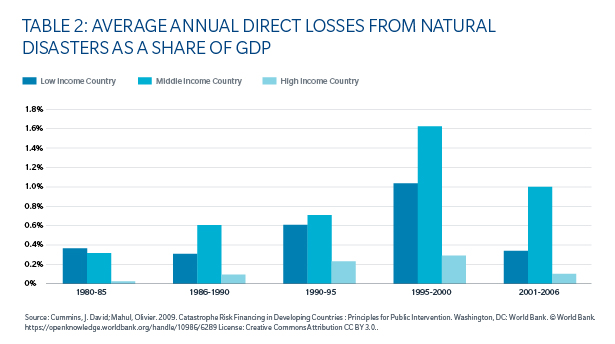

Damage from these losses as a proportion of GDP tends to be much higher than in developed economies (see Tables 1 and 2). If the LAC region is to build on the economic and social gains of recent years, its governments must align with the private sector through public-private partnerships to improve risk management and disaster preparedness strategies.

The ultimate cost of catastrophe-event responses puts particular strain on the public balance sheets of emerging markets, increasing public debt and ultimately burdening taxpayers. Adding to the problem is the lack of insurance coverage in developing countries. Average property insurance penetration in developing countries was only 0.21 percent in 2014, compared to 0.77 percent in industrialized countries (3). Another estimate indicates only 3 percent of potential loss is currently insured in developing countries versus 45 percent in developed countries (4). Mature economies can also often fall back on fiscal safety nets to cover insurance shortfalls. The USD 83 billion budget appropriation approved by the U.S. Congress after Hurricane Katrina hardly registered on the U.S. budget, but most developing economies cannot afford such amounts. For example, a year after Hurricane Ivan hit Grenada in 2004, the country defaulted on its foreign debt.

The Maule, Chile earthquake of 2010 burdened the country with USD 32 million in economic losses, or 15.1 percent of GDP. Despite the high level of insurance coverage in Chile - even by developed world standards - 75 percent of the costs were ultimately assumed by the government, leaving significant opportunity for the private sector to reduce the state’s financial burden.

This piece first appeared on BRINK.

Note:

1. Munich Re NatCatSERVICE, 2016.

2. World Urbanization Prospects, The 2014 Revision; Dept. of Economic and Social Affairs, U.N.

3. http://media.swissre.com/documents/sigma5_2015_en.pdf

4. http://en.fininnov.org/img/pdf/27%20-CCRIF.pdf