Cliff Sheng, Partner and Head of Financial Services, Greater China, Oliver Wyman

Insurtech is revolutionizing the insurance industry by bringing disruptive products and services to a market that is fast adopting, and increasingly moving toward, an online ecosystem. The market is also seeing a surge in the number of people who are aware of and are starting to understand the benefits of insurance.

The China Insurance Regulatory Commission is supporting these gains by fostering a favorable regulatory environment for insurtech. As a result, the insurtech market is experiencing rapid growth and is expected to rise from CNY 250 in 2015 to more than CNY 1.1 trillion in 2020.

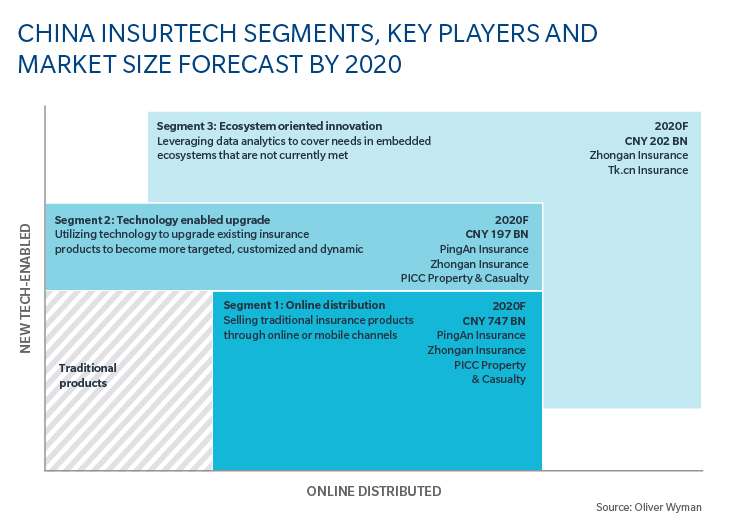

There are broadly three insurtech segments in China (see figure below), which are projected to grow at different rates:

Online distribution of traditional insurance products (for example, online auto insurance sales): According to Oliver Wyman estimates, gross written premiums (GWP) for this segment will grow from about CNY 207 billion in 2015 to about CNY 747 billion in 2020. And within this segment, non-life insurance products will grow at a faster pace than life products.

Technology enabled upgrades of existing insurance products (for example, new health insurance policies or prices based on wearable devices, telematics): GWP for this segment is expected to grow from about CNY 28 billion in 2015 to about CNY 197 billion in 2020. Auto insurance will be the highest contributor to this growth, followed by health insurance products.

Ecosystem-oriented innovation of new insurance products (for example, shipping return insurance, flight delay insurance): Estimates show that GWP in this segment will grow from CNY 12 billion to CNY 202 billion between 2015 and 2020. The key contributors to this growth being the e-commerce and travel ecosystems because of their large market size and the growing desire among consumers to protect themselves against risks related to these ecosystems.

This piece first appeared on BRINK.