In an interview Guy Carpenter’s Lara Mowery, Managing Director, discussed the drivers of the continuing rate reductions in Florida and what it means for the rest of the market. Here she discussed the role of excess capacity at the June 1 renewals.

Was excess capacity still the main driver of the direction of reinsurance pricing at this year’s June 1 renewals?

Clearly we have had some very significant pricing movements in the Florida environment in recent years. As more capital has come into the market and cat bonds have played a bigger role, the Florida renewals in particular have been impacted by this capacity diversification as the key exposed cat region in the world.

The market generally benefits when a reinsurer can use capacity in geographically diverse ways. Florida’s peak zone status makes this more difficult. However, some of the newer sources of capital actually experience reinsurance as a diversification in and of itself. So they weren’t quite as focused on trying to diversify their reinsurance portfolio geographically and therefore weren’t as sensitive necessarily to the amount of capital exposed in Florida. More capital with an interest in Florida risk led to decreased returns.

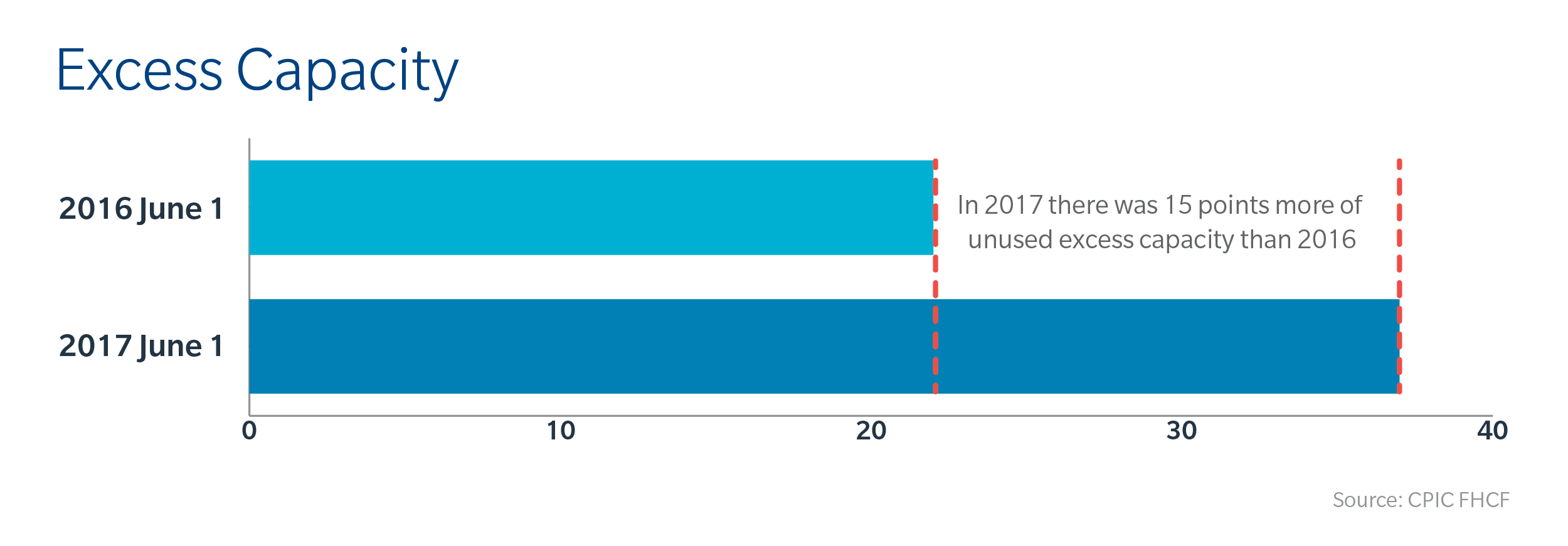

Last year we did see a noticeable moderation in the rate of price decline however. Whereas previously we had seen double digit and high-single-digit decreases, last year was a more moderate price decrease along with less excess capacity through those June 2016 renewals. Last year excess capacity was 22 percent in total, which meant that 22 percent of authorizations were not needed to fulfil reinsurance programs. This number represented excess capacity for all June 1 catastrophe programs in the United States; Florida programs saw capacity tighten even further. This year excess capacity increased to 37 percent. While average price declines did not jump back up in the double digit range, overall decreases averaged slightly more in 2017 versus 2016.

Last year we did see a noticeable moderation in the rate of price decline however. Whereas previously we had seen double digit and high-single-digit decreases, last year was a more moderate price decrease along with less excess capacity through those June 2016 renewals. Last year excess capacity was 22 percent in total, which meant that 22 percent of authorizations were not needed to fulfil reinsurance programs. This number represented excess capacity for all June 1 catastrophe programs in the United States; Florida programs saw capacity tighten even further. This year excess capacity increased to 37 percent. While average price declines did not jump back up in the double digit range, overall decreases averaged slightly more in 2017 versus 2016.

Pricing is something that reinsurers are very sensitive to and watching closely. We are at a point where reinsurers are evaluating all of the characteristics of each individual renewal and making renewal-by-renewal decisions on what they can support. As with last year, there were programs reinsurers had long supported that they had to cut back or decline in some cases. They looked at individual company characteristics, made underwriting judgements and did not just write anything that came in front of them.

*Securities or investments, as applicable, are offered in the United States through GC Securities, a division of MMC Securities LLC, a US registered broker-dealer and member FINRA/NFA/SIPC. Main Office: 1166 Avenue of the Americas, New York, NY 10036. Phone: (212) 345-5000. Securities or investments, as applicable, are offered in the European Union by GC Securities, a division of MMC Securities (Europe) Ltd. (MMCSEL), which is authorized and regulated by the Financial Conduct Authority, main office 25 The North Colonnade, Canary Wharf, London E14 5HS. Reinsurance products are placed through qualified affiliates of Guy Carpenter & Company, LLC. MMC Securities LLC, MMC Securities (Europe) Ltd. and Guy Carpenter & Company, LLC are affiliates owned by Marsh & McLennan Companies. This communication is not intended as an offer to sell or a solicitation of any offer to buy any security, financial instrument, reinsurance or insurance product. **GC Analytics is a registered mark with the U.S. Patent and Trademark Office.