- With IFRS 17, reinsurance for managing capital KPIs needs to be different in type/scale

- Users of internal capital models must ensure flexibility of underlying simulation platform

- Accounting for reinsurance contracts separate from underlying contracts

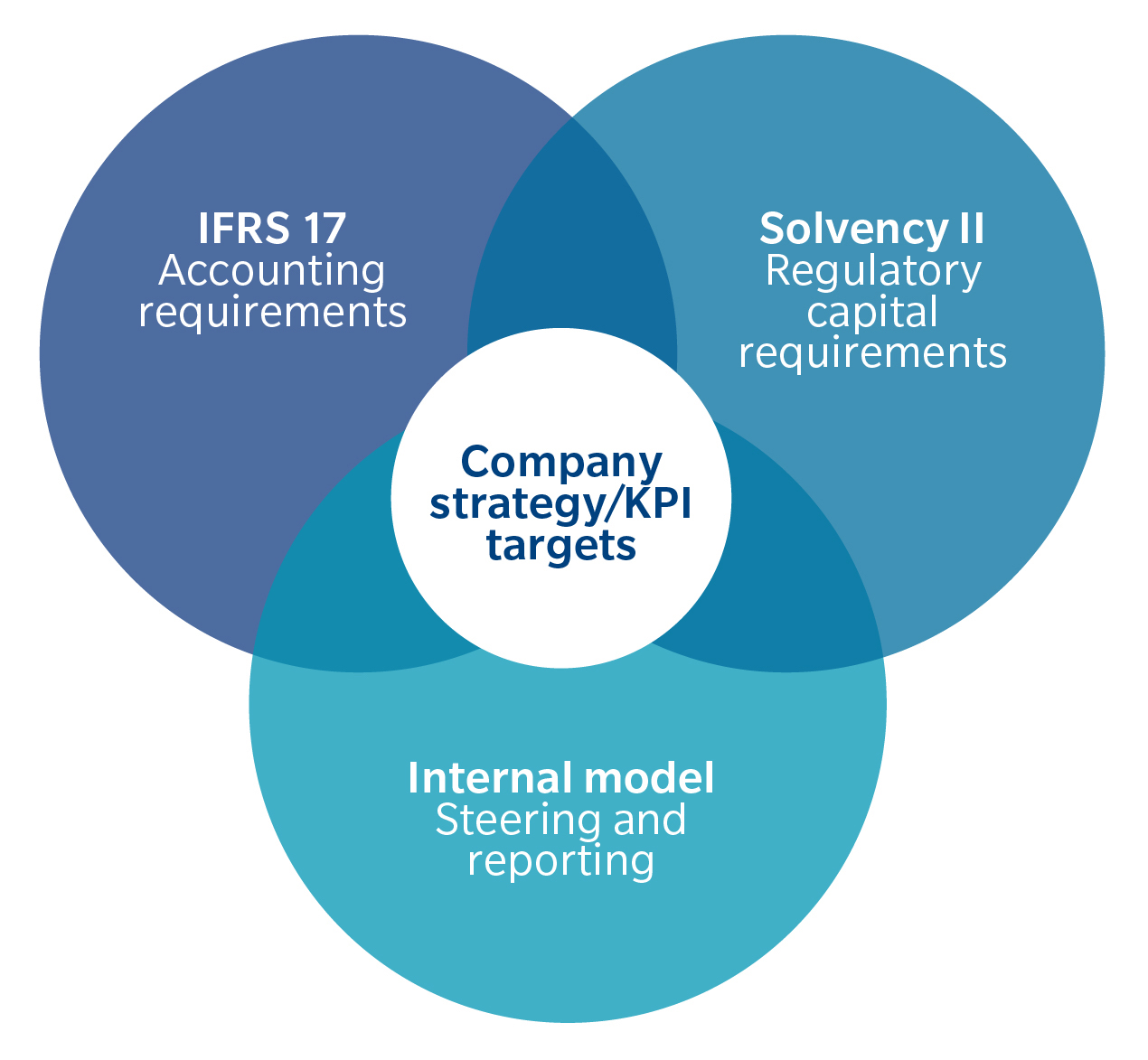

The introduction of International Financial Accounting Standard 17 (IFRS 17) adds another level of complexity to the already challenging (re)insurer legislative and regulatory environment. While IFRS 17 creates a number of changes, particular interest should be made to the significant changes it presents to accounting of insurance contracts. IFRS 17 will establish a fair value view of liabilities and together with the fair value view of assets based on IFRS 9, companies’ balance sheets and income statements are likely to encounter a substantially higher degree of volatility, according to a global roundtable of Guy Carpenter leaders.

“Previously, (re)insurers accounting under IFRS were able to use inconsistent approaches to measure their liabilities,” relates Frank Achtert, Head of Capital Optimization, EMEA. “IFRS 17 closes this gap in recognition, measurement, disclosure and presentation of insurance and reinsurance contracts. In most jurisdictions, IFRS 17 will become effective in 2021 while some countries will opt for earlier adoption.” Insurers monitor key performance indicators (KPIs) that are primarily based on capital (equity, solvency or rating capital) and earnings and its volatility (Earnings per Share (EPS), Return on Risk-adjusted Capital (RoRaC)) to guide management and steer decisions. “Reinsurance purchasing decisions already play a pivotal role in managing these balance sheet and income statement-related KPIs,” adds Tom Hettinger, Strategic Advisory Leader, U.S./Canada. “With the higher degree of volatility introduced by IFRS 17, reinsurance solutions implemented to actively manage capital and earnings KPIs of a company will need to be different in type and scale.”

“Companies will need to ask how infrastructure can be leveraged for the implementation of IFRS 17,” continues David Lightfoot, Head of Global Strategic Advisory – Asia Pacific and Latin America. “Fair value view of liabilities introduced by IFRS 17 is based on estimates of future discounted cash flows plus a risk adjustment based on the uncertainty of those cash flows, representing an accounting sea change that requires significant implementation efforts.”

Companies running an internal capital model have an advantage as they can leverage already existing methods, models and processes to generate financial data for regulatory or management reporting. The benefit applies to (re)insurers adopting the internal model approach under Solvency II or to companies applying the Standard Formula under Solvency II but running an internal model to manage their business. In those cases cash flow calculations for Solvency II overlap with IFRS 17 to a large degree; differences will occur, for example in the treatment of acquisition costs or overhead expenses. Whether the discounted cash flows under Solvency II can also be leveraged for IFRS purposes depends on how the (re)insurer determines the more principle-based discount rate applicable under IFRS 17. “Companies operating under an internal capital model have to ensure that the underlying simulation platform is flexible enough to allow for additional, IFRS 17-induced features. (Re)insurers that rely on the Standard Formula for both regulatory reporting and internal management and steering will face severe implementation challenges,” Achtert explains.

According to Hettinger, the novel fair value view and its implementation in IFRS also dramatically change accounting for reinsurance contracts compared to existing local GAAP or U.S.-GAAP practice.

“Measurement of reinsurance contracts held follows the same principles, but reinsurance contracts are accounted for separately from underlying contracts, which may lead to an accounting mismatch. For example, a loss on a group of insurance contracts within a portfolio is shown immediately for an insurance company. Even in case of a 100 percent quota share protection, profits from reinsurance contracts will be deferred over the coverage period of the reinsurance contract.”

“With IFRS 17, there will be substantial changes in how companies structure their reinsurance contracts because of changing recognition, measurement and presentation of reinsurance contracts and efforts to meet their KPIs,” concludes Achtert. “Clients will need to re-think their approach to structuring reinsurance treaties and prepare now for IFRS 17 implementation.”