- Value proposition of MGAs under increasing scrutiny

- Automation critical to maintaining low cost base

- Remuneration on profit vs commission fees

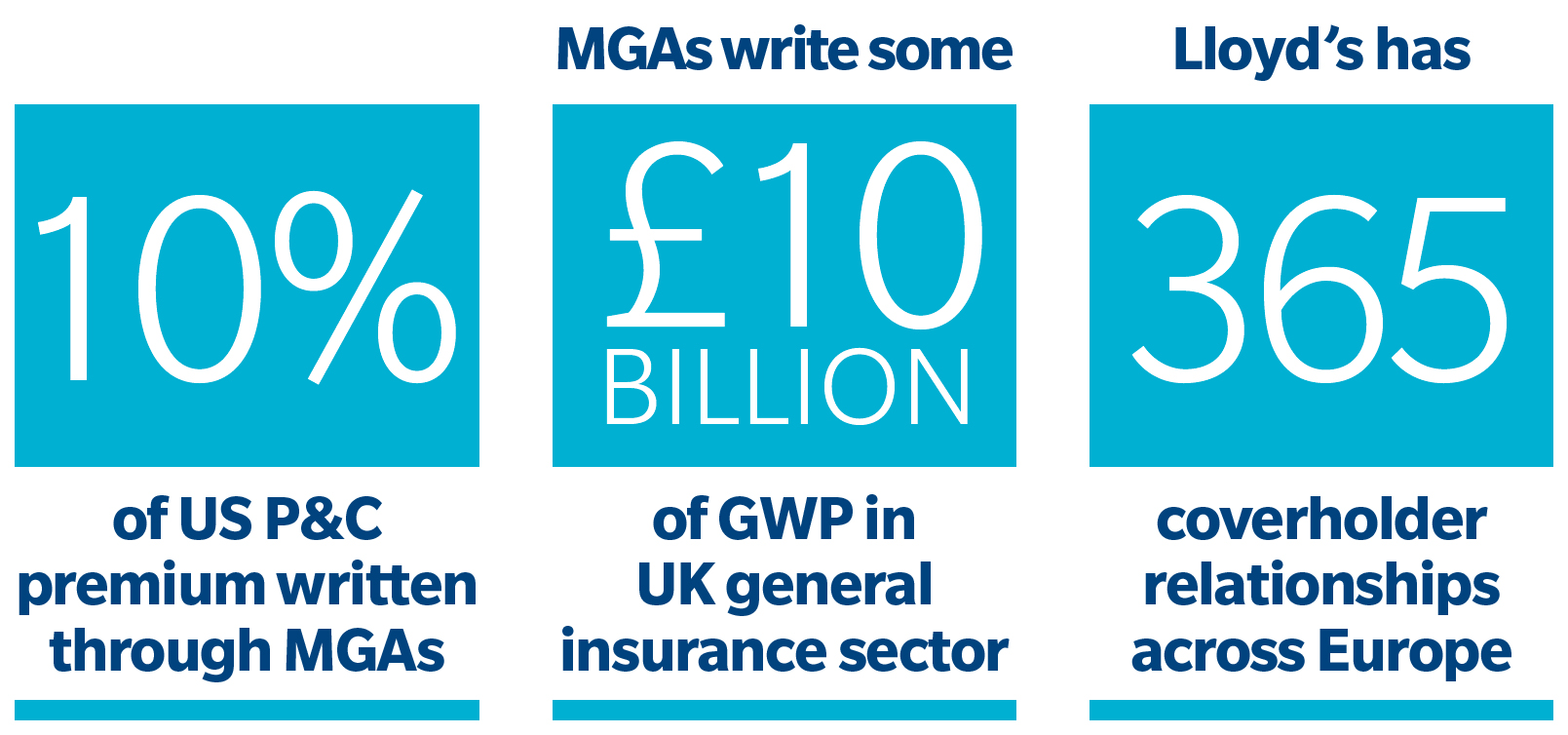

The MGA sector has experienced a period of meteoric growth. Yet while it remains buoyant, multiple pressures could stymie further growth unless MGAs can better demonstrate value to capacity providers, believes Vicky Carter, Vice Chairman – Global Strategic Advisory, Guy Carpenter. “The MGA is an increasingly important part of the insurance distribution chain across a number of lines of business,” explains Carter, “providing a well-established route to market, with experienced, specialist underwriters offering access to many niche sectors or opening new geographies for numerous carriers.”

In the current environment, the MGA model has proven attractive as illustrated by the high multiples achieved in recent acquisitions.

However, Carter warns: “Increasing licensing and regulatory requirements, alongside conduct risk requirements, are challenging to the MGA model and cost structure. Consequently, process efficiency is critical alongside high-caliber underwriting. Carriers won’t foot the bill for MGAs’ underperforming infrastructures.”

“You can produce a very strong pure underwriting performance,” she continues, “yet deliver insufficient margins to carriers. Too often this is because there are multiple human touch-points in the chain, ramping up the potential for human error, reducing speed to market and adding unnecessary cost.”

In many respects, the MGA must be the "poster" company for process enhancement, generating clear value rather than being another link in the distribution chain.

“It’s not just about a first-rate business value proposition, but also providing the most efficient distribution channel possible,” she explains. “Fully automated systems, real-time data processing, instant exposure reporting and the ability to make real-time rate adjustments – these can reduce costs to as low as 5 percent, having a positive impact on the bottom-line and boosting carrier appeal.”

Guy Carpenter, alongside Marsh and Oliver Wyman, partners with startups and established MGAs to streamline processes. “Enhanced efficiency is an increasingly prominent part of MGA differentiation strategies. We’re helping them plan and capitalize on the numerous process advancements entering the sector via the InsurTech conduit, particularly in data transfer automation and machine-learning capabilities.

MGA cost factors also bring into the frame the sustainability of the commission structures upon which many are built.

“Current market pressures mean reinsurers are locked onto underwriting profit and managing down expenses,” says Carter, “which extends to MGAs. Commission-based relationships are coming under greater scrutiny and alternative remuneration structures are being put in place.”

“You simply cannot operate a relationship in which one party capitalizes more on the upswing while the other shoulders any downturn,” she adds. “To create a fully functioning, value-add partnership, the MGA must be remunerated on profit – that’s essential to ensure both MGA and carrier objectives are successfully aligned. It must be a symbiotic relationship.”

Carter also highlights the ability of MGAs to be more versatile and flexible than large carriers. “They offer the perfect vehicle for entrepreneurial underwriters and remove many of the restraints imposed by bigger operations and can also bring new products to market faster.”

“No one doubts the potential that disruption creates,” she concludes. “MGAs must exploit their agility and responsiveness to tackle advances such as automated vehicles, artificial intelligence, or the sharing economy, pioneering new solutions to help open-up previously untapped or non-existent market sectors for carriers. In fact, recently some have shown such confidence in new technologies that they are looking to move from delegated underwriting into risk carrying – to create new insurers.”