The (re)insurance sector is undergoing a period of transition: views of risk are changing and risk appetites are responding accordingly. This shift has manifested itself more acutely in the primary market, as underperformance across multiple lines of business over several years has led to market hardening. This is evidenced by Marsh’s Global Insurance Market Index, which shows global commercial insurance pricing (all lines of business and all regions) rose by 8 percent in the third quarter of 2019.¹ This was the eighth consecutive quarter of price increases and it represents the largest rise since the index was initiated in 2012. Marsh is an affiliate of Guy Carpenter.

The response of the reinsurance market has been more measured overall due to more than sufficient levels of capital relative to risk for most renewal placements, even as reinsurers navigate elevated loss activity and adjust underwriting assumptions to reflect changing perceptions of risk. No doubt, conditions have clearly tightened in the retrocession market as a function of a significant slowdown in capital inflows affecting the balance of supply and demand.

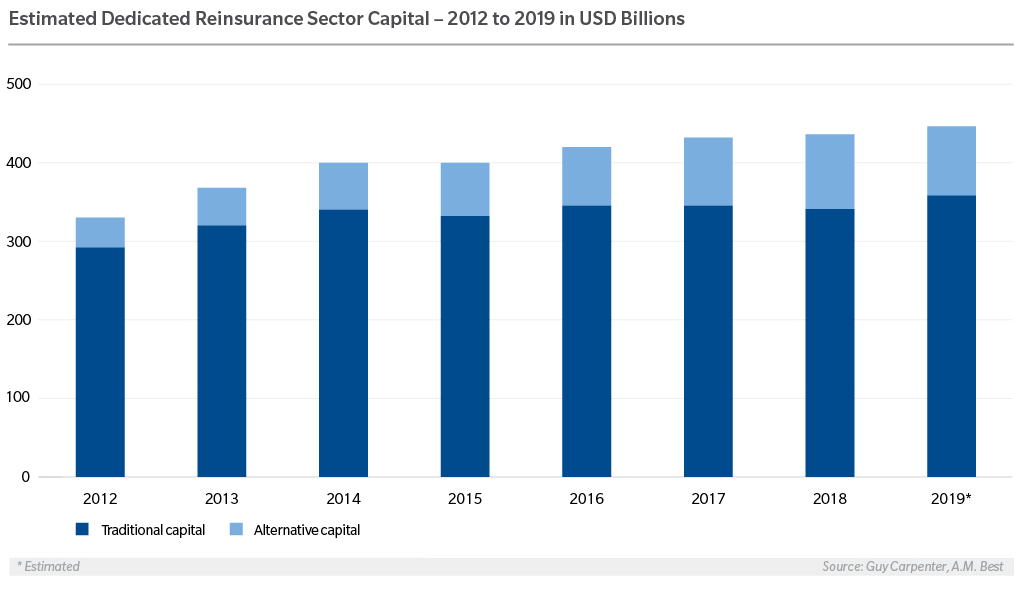

Preliminary estimates calculated by Guy Carpenter and A.M. Best indicate that total dedicated reinsurance capital was up by approximately 2 percent at year-end, driven by increases in rated capital of close to 5 percent (see chart below). Alternative capital contracted by approximately 7 percent as investors were more cautious with new investments after assessing market dynamics and pricing adequacy. When accounting for trapped capital that remains unavailable for immediate deployment due to funding for previous years’ loss requirements, dedicated reinsurance capital was effectively flat compared to a year ago.

While corrections in pricing and structure are occurring, the reinsurance market enters 2020 in a solid position. Capacity will continue to be deployed cautiously, with cedents’ performance and loss experiences scrutinized closely. Yet, the sector remains well capitalized overall and additional capital may be deployed in the coming year should the pricing environment become more appealing to investors. Footnotes: 1: https://www.marsh.com/us/insights/research/global-insurance-market-index-third-quarter-2019.html