The global reinsurance market has been fundamental to the management and mitigation of risk for over 150 years. Guy Carpenter's Protecting our Planet and the Public Purse report examines how the reinsurance market's innate ability and desire to innovate and evolve through different market cycles and periods of change has helped to strengthen the market’s resolve and resilience to losses.

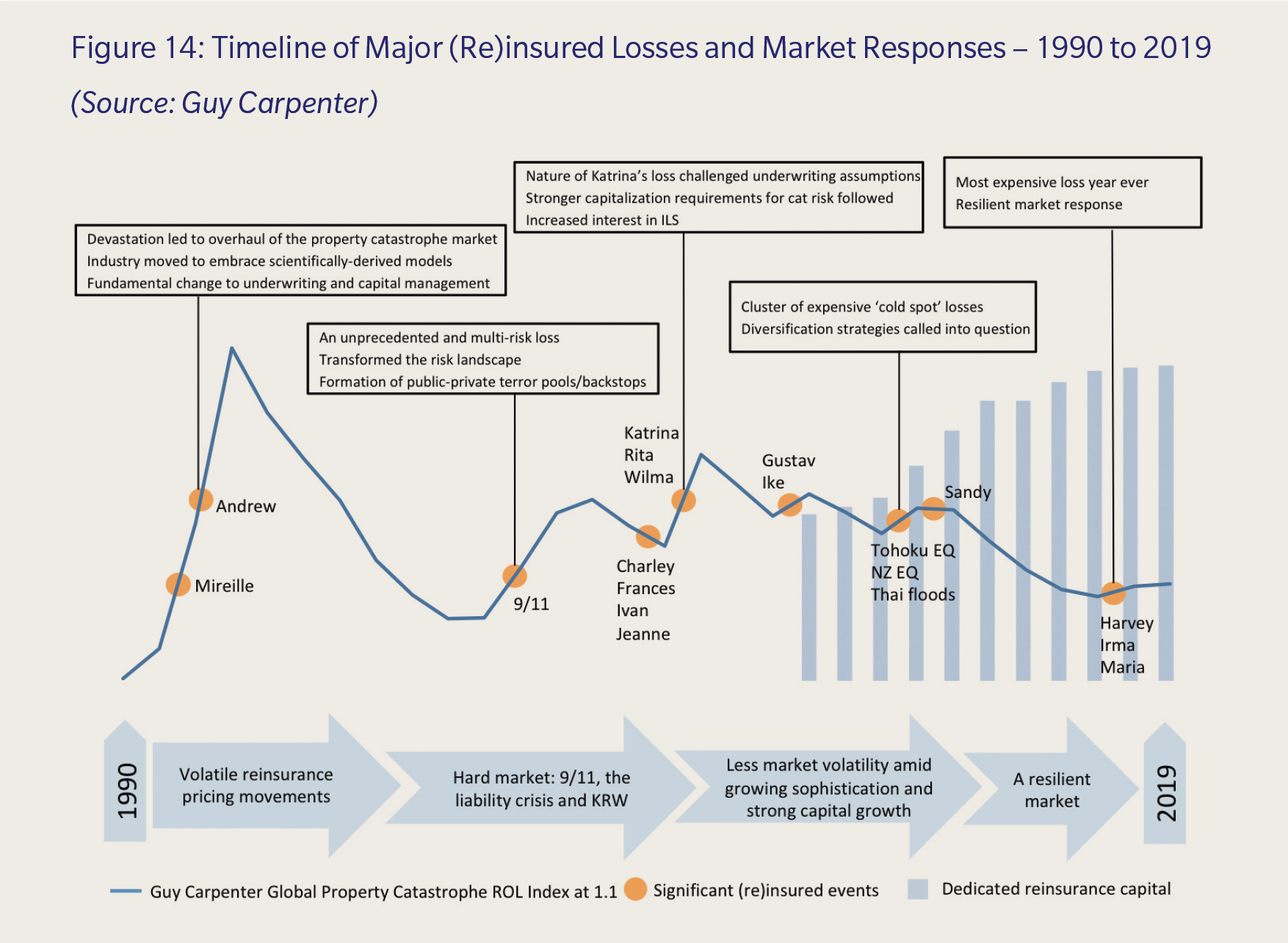

Figure 14 shows how the reinsurance market responded to major events over the last 30 years or so.

As the risk landscapes shifts because of climate change, shifting population distributions and rising inequalities, there is now an opportunity for governments to put this expertise to work by partnering with the (re)insurance market. These risks are, by their very nature, massively disruptive, but the (re)insurance sector is well placed today to withstand most conceivable loss scenarios.

Dedicated Reinsurance Capital

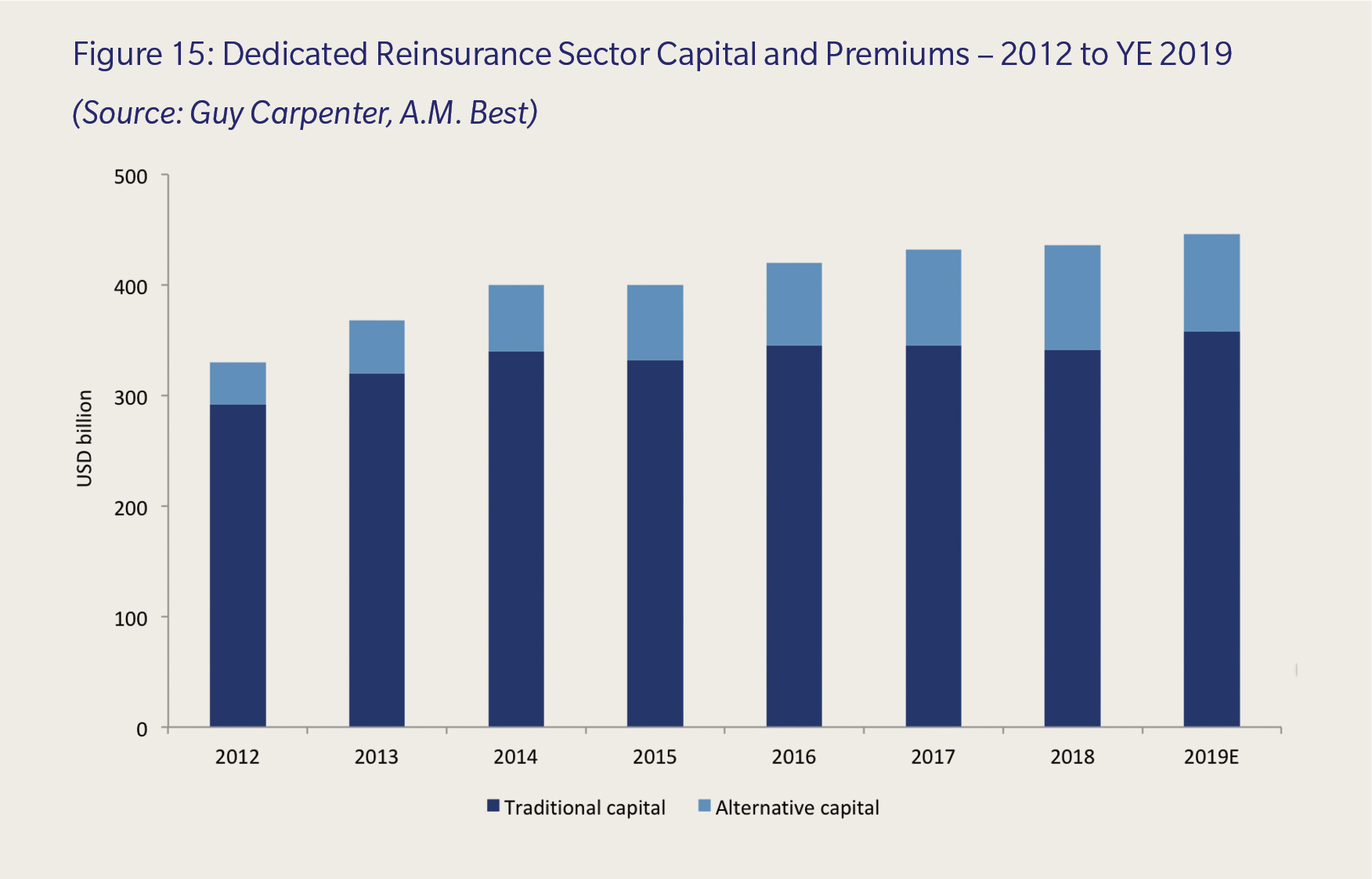

The availability of capital is, of course, crucial to providing a reliable source of funding for (post-disaster) financial recovery. As Figure 15 shows, the reinsurance sector has been operating in an environment of plentiful capacity and abundant capital for several years now, with total reinsurance capital increasing by close to USD 115 billion, or a third, between 2012 and year-end 2019 to reach close to an all time high of USD 446 billion. This is despite facing record breaking catastrophe losses of USD 240 billion in 2017 and 2018.

The vast majority of this growth has come from alternative or Insurance Linked Security (ILS) capital. This asset class, which has been mostly funded by pension fund-provided capital, flowed into the sector more rapidly in 2011 and 2012 as yields in the ILS market reached as high as 12 percent, with expected losses as low as 3 percent. Such a proposition has proven to be attractive to investors in the wake of the global financial crisis, especially given its additional appeal of low correlations.

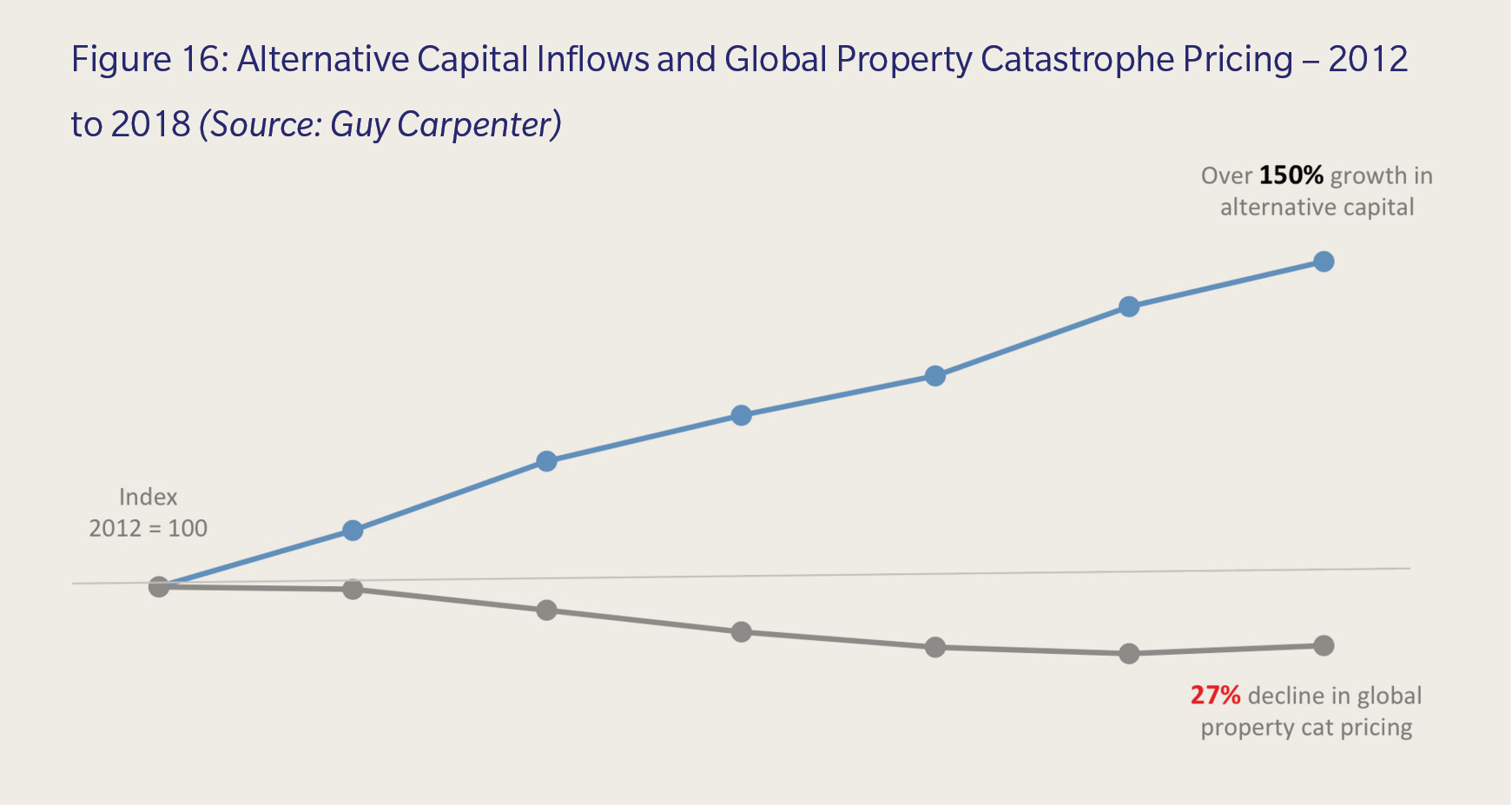

The entry of tens of billions of dollars of alternative capital into the sector has transformed the market. Alternative capital rose by 150 percent between 2012 and 2018 (see Figure 16). Using the largest class of reinsurance, property catastrophe, as a proxy, this growth unsurprisingly led to a corresponding fall in the cost of reinsurance. It should also be noted that current alternative capital inflows represent only a small fraction of the volumes that could potentially arrive from the capital markets, although market conditions would, of course, dictate the opportunity to deploy additional capacity at acceptable risk parameters.

Private-Public Partnership Putting reinsurance capital to work to create new coverages and meet evolving demands from public sector entities will be crucial as new risk pools emerge. At a time when governments worldwide are being forced to bear a growing share of natural catastrophe losses, and face multiple challenges in funding increasing costs associated with aging populations and higher debt, the reinsurance market has already established itself as a capable private partner for the public sector. The findings and observations in this paper outline the potential magnitude of change and challenge that climate and demographic shifts could bring to nations in the years and decades to come. More importantly, the report also shows that the reinsurance market is a resolute and capable partner for public sector risk. Guy Carpenter looks forward to working with governments and markets to help de-risk public sector balance sheets through risk transfer to the private sector. Read Protecting our Planet and the Public Purse >> Click here to register to receive email updates >>