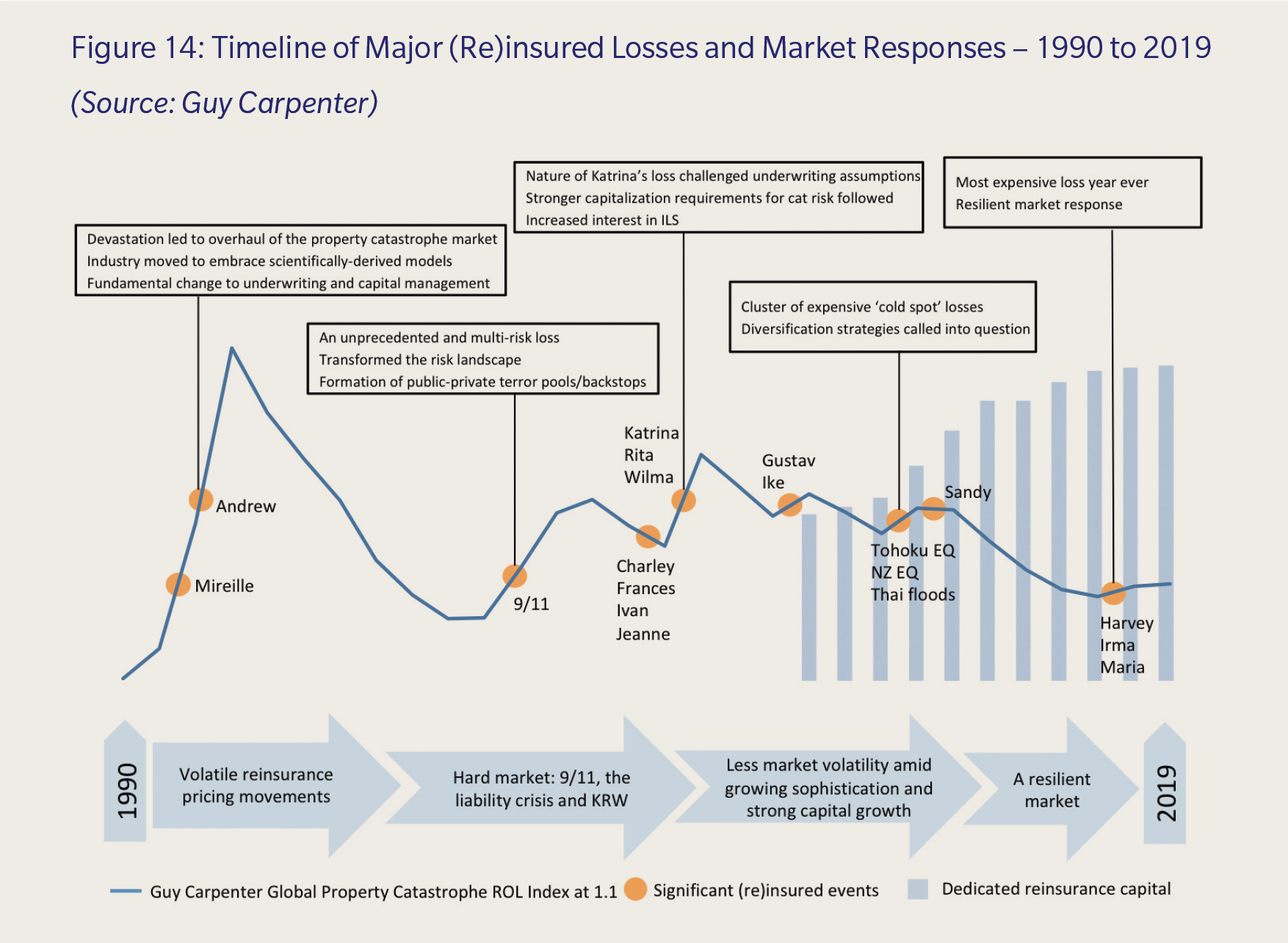

The global reinsurance market has been fundamental to the management and mitigation of risk for over 150 years. Guy Carpenter’s Protecting our Planet and the Public Purse report examines how the reinsurance market’s innate ability and desire to innovate and evolve through different market cycles and periods of change has helped to strengthen the market’s resolve and resilience to losses. Figure 14 shows how the reinsurance market responded to major events over the last 30 years or so.

Dedicated Reinsurance Capital

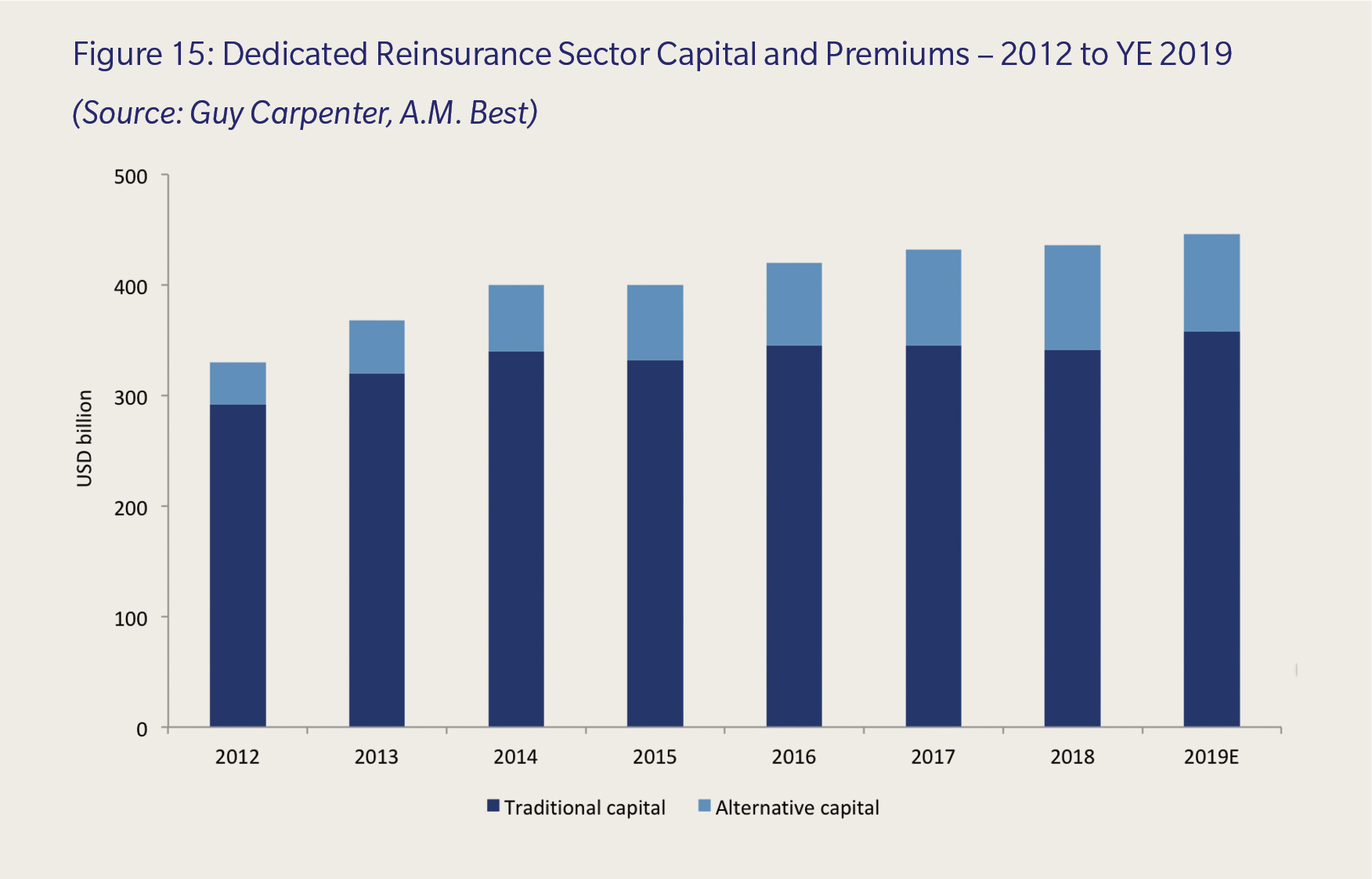

The availability of capital is, of course, crucial to providing a reliable source of funding for (post-disaster) financial recovery. As Figure 15 shows, the reinsurance sector has been operating in an environment of plentiful capacity and abundant capital for several years now, with total reinsurance capital increasing by close to USD 115 billion, or a third, between 2012 and year-end 2019 to reach close to an all time high of USD 446 billion. This is despite facing record breaking catastrophe losses of USD 240 billion in 2017 and 2018. The vast majority of this growth has come from alternative or Insurance Linked Security (ILS) capital.

This asset class, which has been mostly funded by pension fund-provided capital, flowed into the sector more rapidly in 2011 and 2012 as yields in the ILS market reached as high as 12 percent, with expected losses as low as 3 percent. Such a proposition has proven to be attractive to investors in the wake of the global financial crisis, especially given its additional appeal of low correlations.

Read more on page 39 of the Protecting our Planet and the Public Purse report >>