As the COVID-19 situation is changing on a daily basis, the impact to the insurance and reinsurance markets is not yet fully known. However, given the significance of the developments, Guy Carpenter is providing the following view of how COVID-19 may impact the medical (re)insurance market.

There are three main types of medical reinsurance: excess of loss, quota share and aggregate. Of these, excess of loss, also known as specific reinsurance, is the most common.

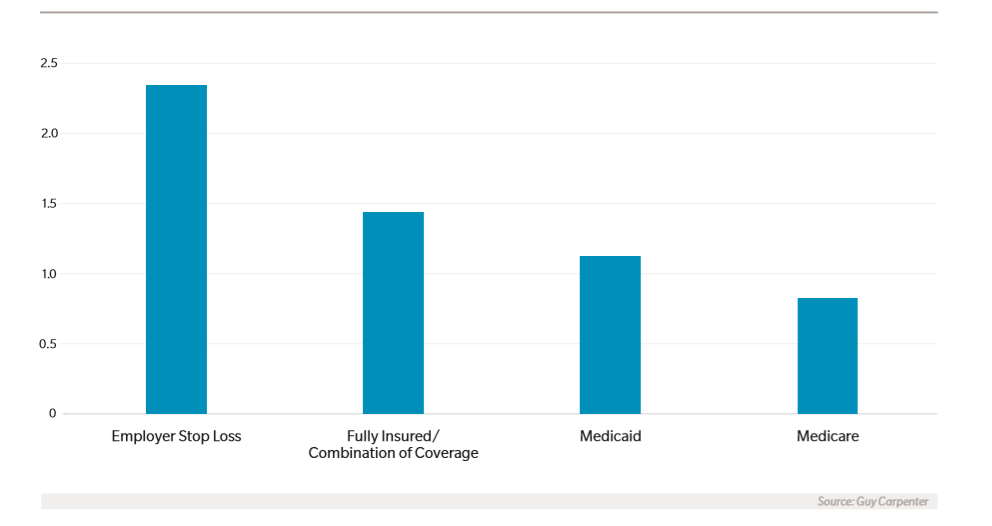

Excess of loss reinsurance reimburses health insurers when annual per member medical costs exceed a pre-determined threshold. According to data from Guy Carpenter’s 2020 GCMarketPulse Report, shown in the chart below, the average per member retention for Guy Carpenter healthcare clients is just under USD 1.5 million, with Medicare carriers generally having the lowest retentions and employer stop loss carriers purchasing higher retentions.

Average Member Retention: Healthcare Clients – USD Millions

Given these retention levels and the previously discussed estimated costs associated with COVID-19 care, it is unlikely this outbreak will have a wide impact on the majority of excess of loss reinsurance contracts. However, certain health insurers (and captives) purchasing relatively low per member retentions will likely experience a material impact at their next reinsurance renewal.

While less common, quota share and aggregate reinsurance contracts have a higher likelihood of being triggered by the COVID-19 pandemic. In contrast to excess of loss contracts, which generally provide per member severity protection, quota share and aggregate contracts provide health insurers with financial protection as a result of an increased frequency of claims. While we do not anticipate seeing a significant spike in individual claim severity, as more and more individuals become infected, claim frequency is significantly increasing. On the carrier side, this increased frequency may lead to losses for health insurers offering employer stop loss policies including aggregate coverage.

Click here to read the report >>

Click here to register to receive email updates >>