Guy Carpenter has developed a model that mirrors aspects of how rating agencies perform stress tests on accident and health company financials. The test looks at the effects COVID-19 has on the marketplace and provides benchmark comparisons of company capital levels by estimating changes to company-level RBC ratios based on stresses to both assets and liabilities. The results of Guy Carpenter's stress test show an average 24 percent drop in risk-based capital (RBC) ratios, though companies will have different sensitivities to the test based on their distribution of assets and liabilities. The largest change in ratio for any company was a 58 percent drop.

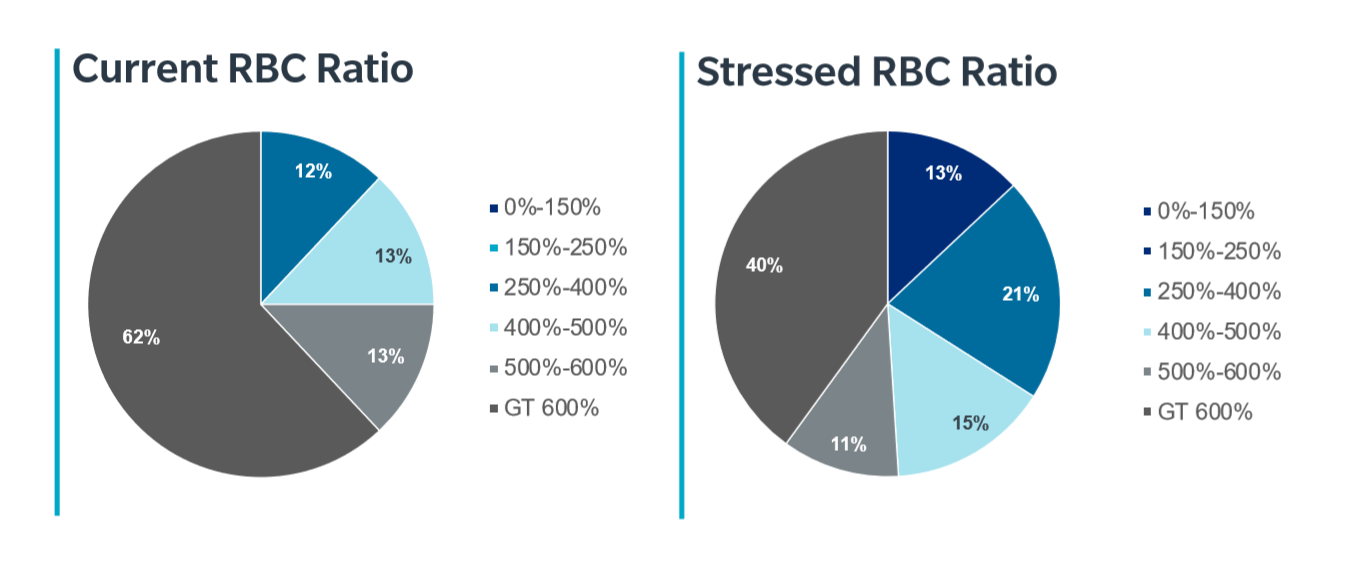

For the 100 companies included in the sample, the lowest starting RBC ratio was 309 percent. After applying the stressors to the current ratios, 13 percent of the companies had a ratio between 150 percent and 250 percent. Additionally, at the top end of the spectrum, only 40 percent of companies had ratios in excess of 600 percent, compared to a starting point of 62 percent. The following charts show how the distribution changed due to the test.

Note on stress test limitations: The overall calculations are based on a random sample of companies. There could be unintended biases in the selection, and the overall results could change based on another sampling. The liabilities that were stressed focused on accident & health type premiums and group life exposures. Liabilities such as individual life, annuities, etc. are not included; as such, this is a partial view.

Read Part II of the article >>