The continued concerns over the conflicts and instability in Ukraine, Russia and Belarus have reinsurers in Europe pursuing full exclusion of losses on accident catastrophe contracts occurring within the region. These factors, combined with recent losses from COVID-19 and frequency of losses in the broader marketplace, contributed to a challenging environment for the accident catastrophe sector during January 1, 2023, renewals, and are expected to continue playing a significant role in the market going forward.

Key takeaways identified by Guy Carpenter from the 2023 accident catastrophe renewals

Recent loss events have greatly diminished reinsurers’ appetite for taking on systemic perils, particularly when these perils are not rated for or defined in the contract. The COVID-19 pandemic has been a catalyst for the insurance market looking at how they are exposed to systemic risks and the approach to manage them.

Capacity

- Treaty capacity levels remained consistent with 2022: USD 700 million to USD 1 billion (depending on price).

- There was one new market entrant at January 2023.

- There was a trend toward a more conservative approach to deploying maximum line sizes and managing aggregates compared to prior years.

- Aggregate for nuclear, biological, chemical and radiological (NBCR) capacity for programs with exposure in key territories such as California and New York remained selective, limited and price-driven.

Price

- The rating environment was hardening but was stable for loss-free renewals.

- Interest rate and inflation environments contributed to pressures on cost of capital.

- Price changes:

- Flat to up 5%—loss-free and non-hazardous territories

- Up 5%-10%—first tier loss-free, with high-risk war countries

- Up 10%+ for retrocessional, including high-risk war countries

- Loss-impacted programs generated bespoke pricing.

Coverage

- The retrocession market drove terms and conditions.

- There was a consolidation of event and exclusion definitions across the market.

- Territorial war exclusions were introduced where there was known exposure in high risk territories.

- Reinsurance solutions were available with additional premium or as a carve-out via treaty or facultative placements.

- Epidemic/pandemic or contagious disease coverage remained limited for travel-inclusive covers.

- 168 hours clause is now market standard. At January 1, 2023, we saw the introduction of radius clauses to limit countrywide aggregation of terrorism losses. From a terror point of view, this would be an “extension” compared to how the World Trade Center attack of September 11, 2001, was defined as being 2 separate events. However, this is a further limitation within the contract.

- Systemic risk exposures continued to be addressed from 2020 onward via:

- Communicable disease exclusion(s) Lloyd’s Market Association 5500.

- Cyber affirmation or exclusion mandate 5467 by Lloyd’s effective January 1, 2021.

- War, exclusions for active war, nuclear war and passive war in country of domicile.

- Nuclear biological chemical excluded but written back for terror.

An Ever-Shifting Political Environment Drives Contract Changes

Discussions on what constitutes “declared war” have emerged–the dictionary definition of which is “a formal statement made by one country to another that a state of war now exists between them.”1 Reinsurers are examining how their various contracts address what happens if war is not declared but areas are functioning like war zones, whereas the original intent was to exclude war behavior. How is passive war coverage being considered? Although it is less likely, what about the threat of nuclear war or a nuclear incident within these areas of conflict?

These concerns had reinsurers and clients revisiting language and pushing for their own interpretations, resulting in non-concurrencies on largely syndicated programs. The interpretations can vary from reinsurer to reinsurer, especially as they strive for their wording to match their retrocessionnaire. Where clients confirmed no exposures in Ukraine, Russia or Belarus, reinsurers took a logical approach and did not require additional contract language. We expect the marketplace will find some common ground in the coming months, especially for the Lloyd’s syndicates, which will decrease the unique wordings for 1 exclusion within a treaty.

Refocus on Capital and Coverages: Accident catastrophe renewals were dominated by a focus on war and the potential escalation of the Russia/Ukraine conflict, and more specifically the extent to which a reinsured is covered for passive war where the original insured is covered in their country of domicile. Another factor is the ability to provide reinsurance coverage for losses arising from nuclear, biological, chemical and radiological (NBCR) war. Close attention has been paid to direct and indirect exposures within Russia, Ukraine and Belarus, resulting in a variety of exclusions being released by the market and imposed where deemed required.

Reinsureds and reinsurers alike showed a split preference for further pre-loss clarification of a war loss definition. A number of reinsurers created and supported a specific clause to reduce considered loss ambiguity from the outset, acknowledging that a typical accident loss is required to be from an identifiable time and place.

This was achieved by limiting time and radius, which reduces pressure on the need to prove the loss is from an identifiable time and place. In some instances, there was a trend to limit countrywide aggregation for terrorism losses within loss occurrence definitions of 168 hours on catastrophe event programs. From a September 11, 2001, attack scenario, this was defined as being 2 separate events, so on this basis it would actually be an extension for terror cover. However, this is a further limitation on the contract.

Constrained Retrocessional Capacity and Global Catastrophe Loss Activity: The retrocessional market continued to harden at January 1, 2023, with a strong focus on rating adequacy and scope of coverage. This resulted in increased pricing and higher attachments. Concerns surrounding systemic perils, such as war, nuclear, biological and chemical war and terrorism, pandemic and cyber, in addition to frequency of losses in the broader marketplace, have contributed to a challenging environment.

The cyber market experienced significant rate increases from 2020 through 2022, helping to reduce the industry's overall loss ratio. However, as rate increases decelerate in 2023 and ransomware and privacy claims rise, cyber continues to be a dynamic and evolving marketplace that needs to be watched closely.

Property reinsurance had seen historical severity trends going up over the past several years, with notable increases from events such as Hurricane Ian in September 2022. The accident and health market was historically uncorrelated from general market losses.

However, catastrophic events such as Ukrainian Air Crash, COVID-19 and the threat of the conflict in Ukraine and concern surrounding escalation of war have had broader impacts including accident and health reinsurers. In addition, over the past few years, the COVID-19 pandemic raised concerns on how sickness claims are addressed and excluded under accident covers.

Redeployment of Capital: With increased activity in property losses, reinsurers are achieving significant rate increases over the expiring year on loss-free programs, which is attracting capacity away from the accident catastrophe marketplace, where rates have experienced modest increases year over year.

Ongoing Conflict in Ukraine and Concern Surrounding the Escalation of War: The conflict continues to drive uncertainty in the region and the world, putting pressure on clients to re-evaluate policies in the regions as reinsurers take a cautious approach in providing coverage. Finland recently joined NATO, causing Russia to take notice and warn of action.3

Potential Issues with Taiwan and China: While much attention has been devoted to concerns over the Russia-Ukraine conflict, reinsurers are growing increasingly concerned about the situation in Taiwan with regard to possible invasion from China. In addition to exposures in Russia, Ukraine and Belarus, reinsurers are now keen to understand clients’ exposures in Taiwan as well, including whether or not they include active and/or passive war and also nuclear, biological, chemical and radiological (NBCR) passive war cover.

COVID-19 in Japan: In the second half of 2022, the personal accident line saw increased claims growth driven by a spike in positive COVID-19 cases. In Japan, insurers distributed hospitalization benefits to a wide range of policyholders infected with the coronavirus even if they self-isolated at home or in hotels in accordance with government guidelines instead of being hospitalized. The industry, however, started limiting the payments of the benefits to COVID-19 carriers at high risk of developing severe symptoms, such as people aged 65 or older and pregnant women, on Sept. 26, 2022. The move is expected to push down hospitalization benefit costs over time, but levels of payments are expected to remain high for the time being given that it takes some time before infected policyholders file their insurance claims.4

The most recent round of renewals in Japan effective April 1, 2023, now contain COVID-19 exclusionary language, which was precluded earlier. Renewal pricing has increased significantly.

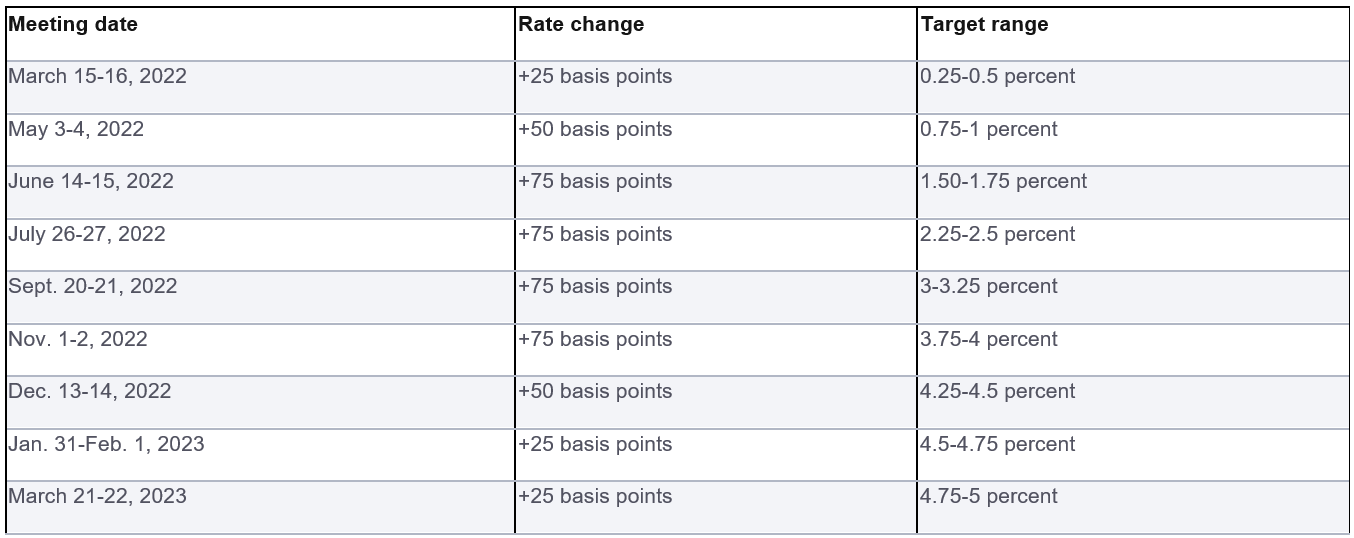

Rising Inflation and Interest Rates: As the world economy continues to make adjustments, its effects have been felt in the insurance industry. Annual inflation rates in the US took a notable jump from 1.4% in 2020 to 7% in 2021. Inflation remains high (6.5% in 2022 and 6% in 2023, respectively), with wage inflation driving benefit amounts and policies over and above what they have been before. Insurance carriers continue to reassess their TSI (total sum insured) and necessary coverages, while reinsurers weigh that risk in their coverage approach.2 In an effort to slow inflation, the US Federal Reserve has significantly increased interest rates in the past 12 months, which puts pressure on cost of capital and reserves.

Source: Fed’s Interest Rate History: The Fed Funds Rate Since 1981, Bankrate

How Guy Carpenter Can Help

Guy Carpenter is a leader in risk and capital solutions, delivering a powerful combination of reinsurance broking expertise, capital solutions, strategic advisory services and industry-leading analytics. Our unsurpassed market presence and knowledge enable innovative solutions to client accident and catastrophe challenges with the best terms and conditions the reinsurance market has to offer. Clients are empowered by our leading analytics to make informed decisions.

Contacts |

||

Kathleen Russo |

Zara Ulusoy |

Frank Ross |

Senior Vice President |

Senior Vice President |

Risk Analyst |