Climate change and extreme weather are increasingly important for multiple stakeholders, including regulators, rating agencies, investors and risk managers. This briefing examines how climate change affects physical risks posed to insurers with exposure in Australia, New Zealand, Papua New Guinea and the Pacific Islands, and the evolution of regulation associated with this risk.

Introduction

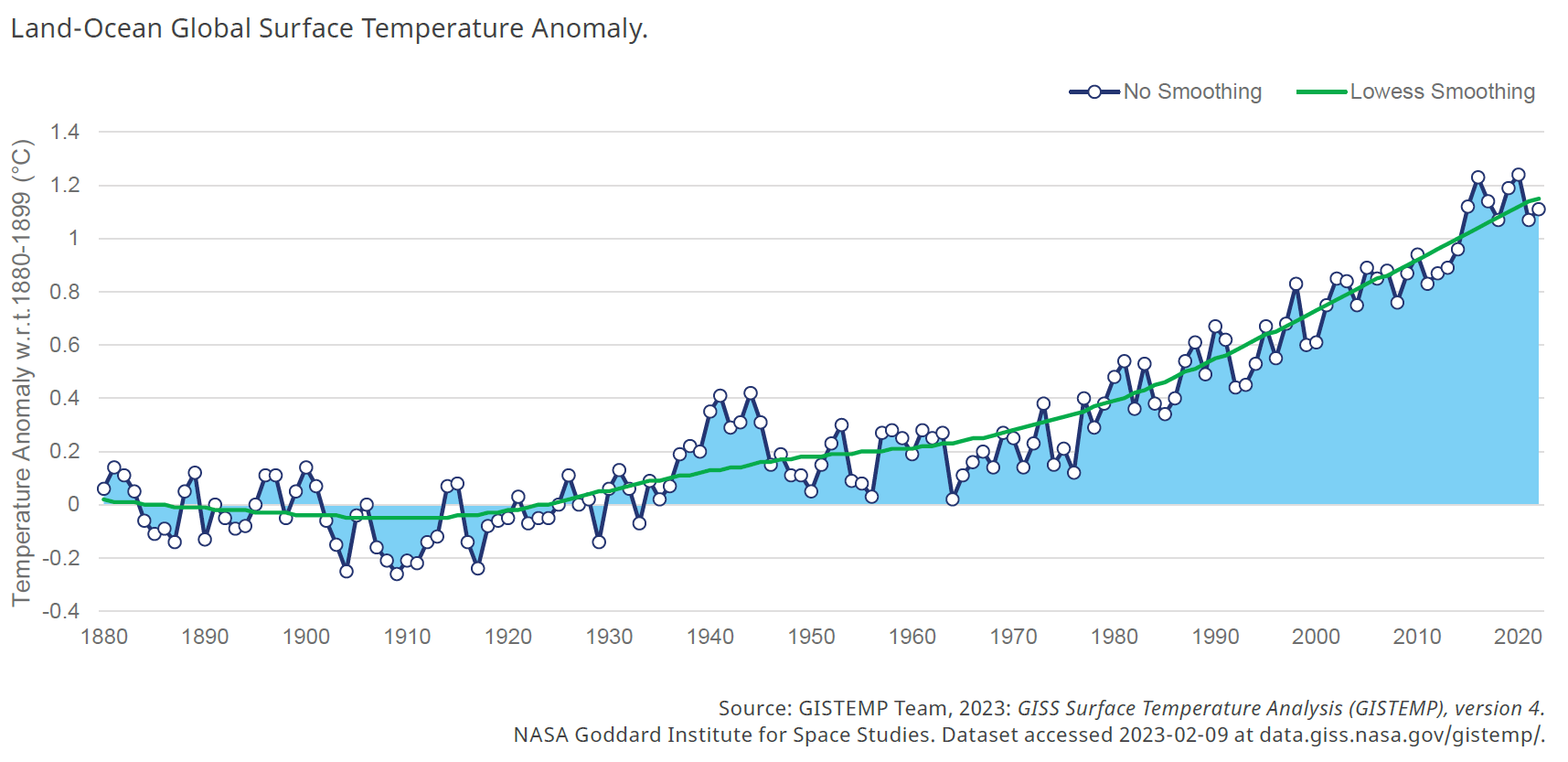

There is increasing pressure on insurers to understand climate change’s impacts on damaging weather. The National Aeronautics and Space Administration (NASA) reported that 2022 was the fifth-warmest year on record, with the average surface temperature 1.11°C warmer than pre-industrial times. (See figure below. Click the image to see larger version of the graph.)

Regulation

Climate change presents 2 key forms of financial risk: those associated with a transition to a lower-carbon economy, and those related to the physical impacts of climate change. The physical impacts can be assessed and reported as either chronic or acute. Chronic physical risks are gradual changes in weather patterns, such as rising sea levels, droughts and extreme temperatures.

Acute physical risks are sudden and severe events that can cause significant damage to property and infrastructure, such as hurricanes, floods, wildfires and storms. Mandatory reporting of these risks, often aligned with the recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD), has come into effect in several jurisdictions. Scenario analysis has also emerged as a key forward-looking tool to assess and disclose the potential impact of climate risks.

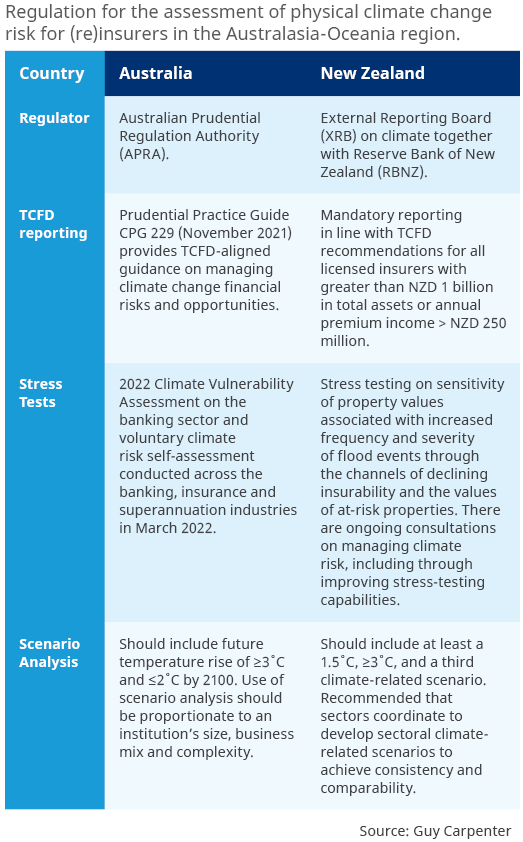

In Australia, the Australian Prudential Regulation Authority (APRA) released guidance on managing climate change physical risks and opportunities in November 2021 (CPG 229). The APRA climate risk self-assessment survey, released in March 2022, provided insight into how (re)-insurers are aligning their practices to the guidance. Key observations from the survey indicate that the use of more advanced quantitative risk metrics, including forward-looking exposure to physical risk, was limited and is a key area for development. Given the uncertainties of these risks, APRA expects responses to be proportionate to the size, nature and complexity of the business, improving over time.

In New Zealand, the government has legislated for mandatory reporting of climate risks. The disclosure regime, being developed and overseen by the External Reporting Board (XRB), applies to licensed insurers with greater than NZD 1 billion in total assets or annual premium income greater than NZD 250 million. The initial NZ CS 1 Climate-related Disclosures framework is applicable from 1 January 2023, with the first reports expected as part of year-end reporting on 31 December 2023. Through ongoing consultations, the Reserve Bank of New Zealand (RBNZ) is keen to facilitate reliable and timely climate-related risk disclosure as well as improving capabilities in climate scenario analysis and stress testing.

Specific guidelines and requirements for climate change physical risk analysis are highlighted in the table below.

Managing Climate Change Physical Risk In Australasia-Oceania

Evolving Risk Landscape

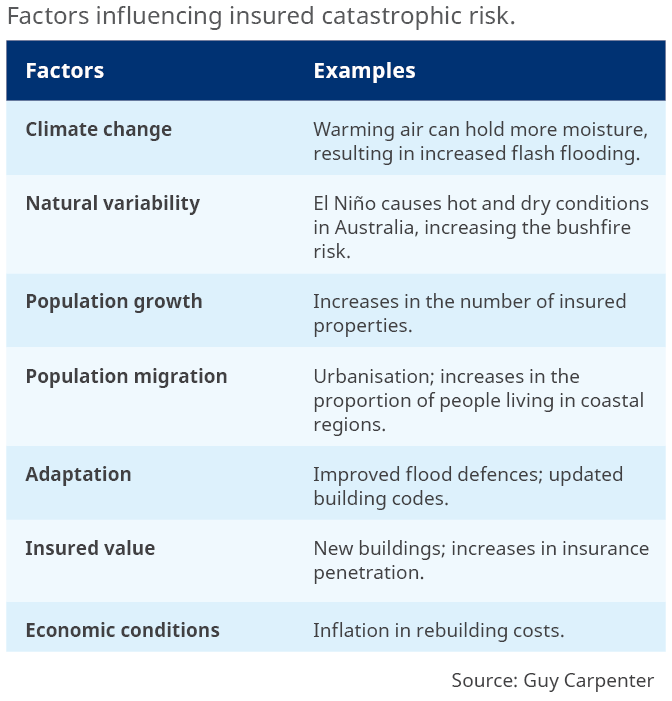

The frequency and severity of natural catastrophes are expected to increase due to climate change. The subsequent impact on insured loss is highly dependent on the peril and region of interest and is described in the section Climate Change Impact by Peril.

Climate change is not the only factor influencing how the financial catastrophic risk to re(insurers) changes from year to year. Climate change generally changes the risk gradually over time, although the financial impact may only be realised when a significant event occurs. In contrast, other factors can lead to more abrupt changes in risk, such as the impact of inflation in rebuilding costs or the implementation of flood defences. These other factors will often have a larger impact than climate change, and we compare examples of them and climate change in the table below.

Case Studies

Scientists have recently developed methods for establishing the role of climate change in the occurrence of significant events. Here we examine the attribution science for 2 significant events.

Bushfires in Australia

The devastating Australian bushfire season of 2019-2020 caused widespread loss and at least 33 fatalities. PERILS reports the peak industry event loss from 30 December 2019 through 5 January 2020 was AUD 1.866 billion.

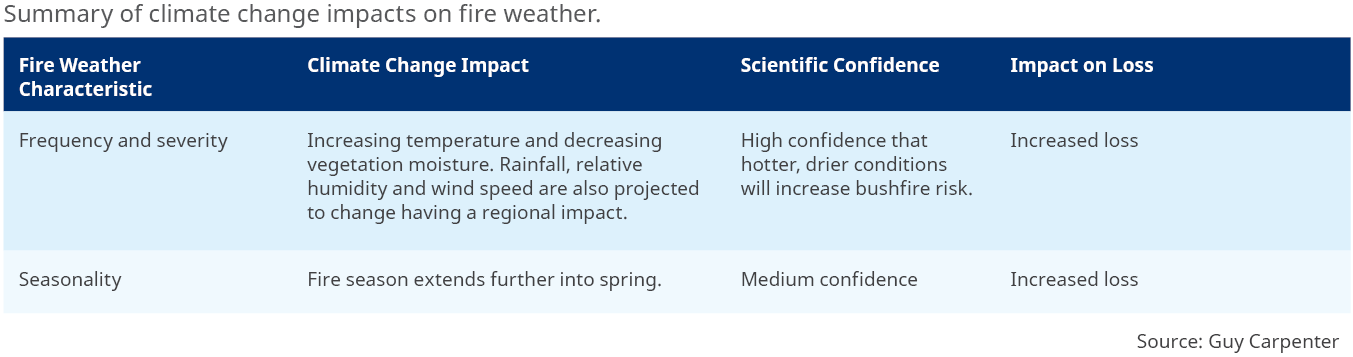

A scientific attribution study found climate change increased the likelihood of the event occurring from a fire weather index and extreme heat perspective. However, the study did not link the drought conditions to climate change, and notes that the Indian Ocean Dipole and Southern Annual Mode also played a role. Further details on how climate change impacts fire weather is outlined in the table Summary of climate change imacts on fire weather.

Cyclone Gabrielle

The North Island of New Zealand was subject to extreme rainfall and strong winds as Tropical Cyclone Gabrielle bypassed the island in February 2023. The damage was substantial. PERILS’ first estimate of the industry loss for the event was NZD 1.543 billion.

Several factors caused the high losses associated with Gabrielle:

- The rare occurrence of a tropical cyclone in the vicinity of New Zealand.

- The exceptionally heavy rainfall associated with the cyclone.

- The arrival of the storm just 2 weeks after significant flooding in Auckland.

Climate change has a different impact on each of these factors:

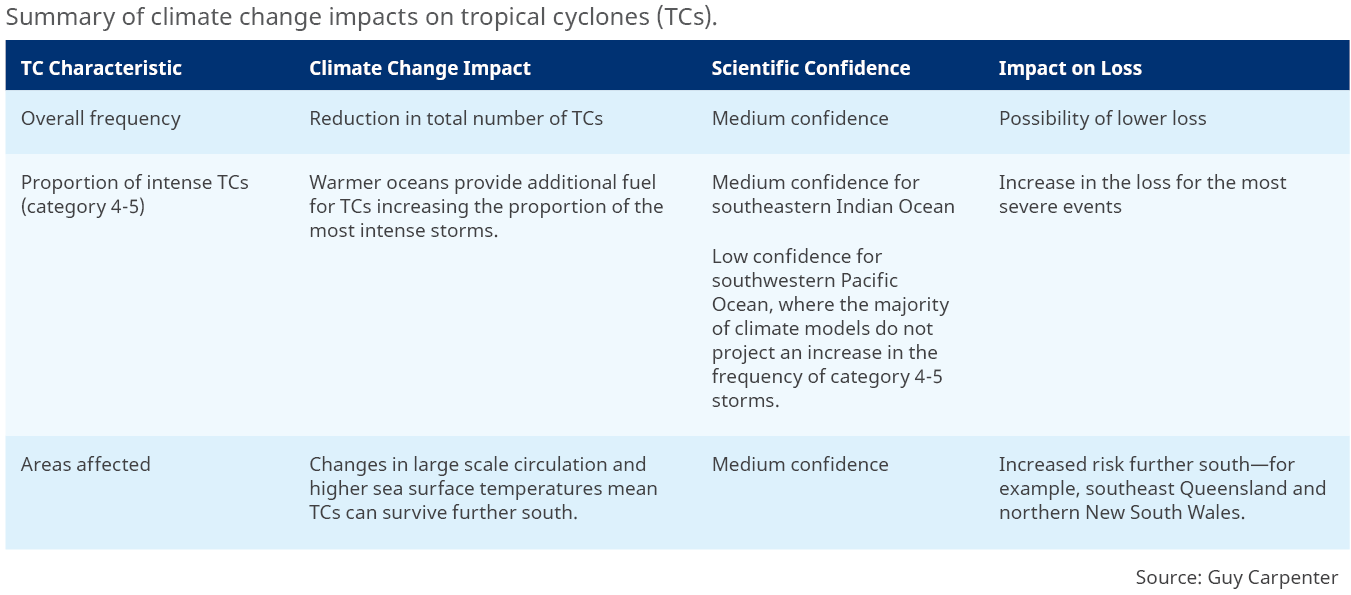

- There is no strong evidence to suggest the frequency of tropical cyclones affecting New Zealand will increase. There is evidence that cyclones will be able to survive further south, but this is counteracted by an expected decrease in the overall frequency of tropical cyclones (see Table 6).

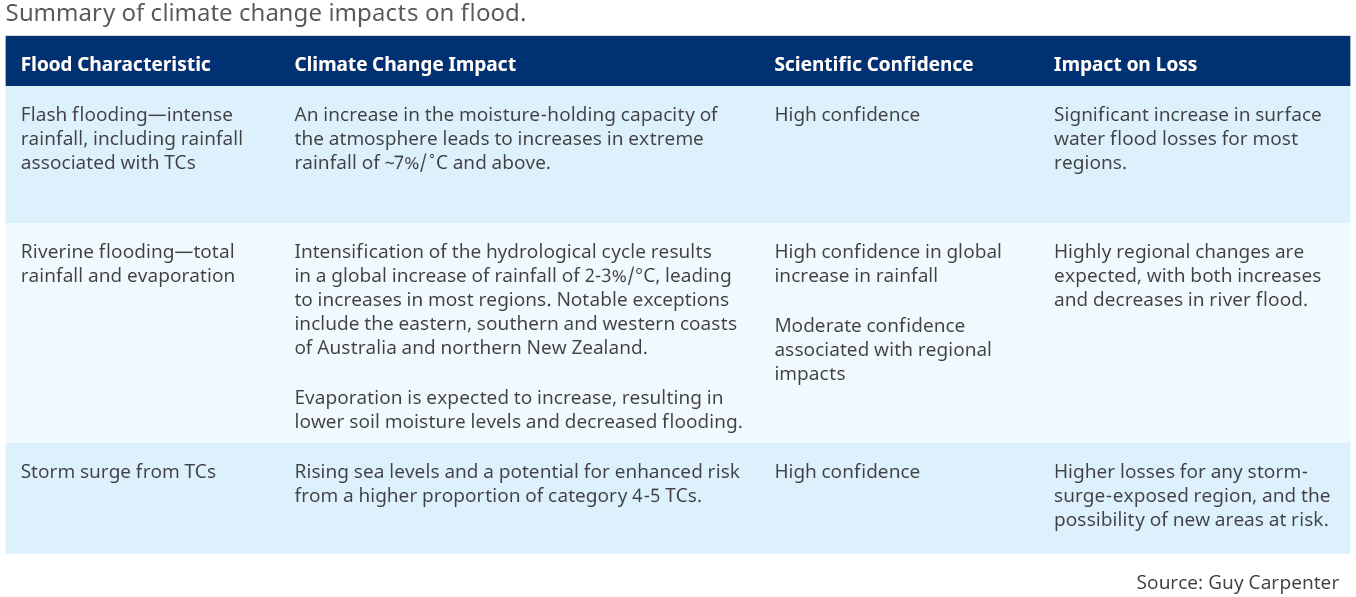

- The exceptionally high rainfall associated with Gabrielle has become more likely as a result of climate change, and will continue to become more likely (see the table Summary of climate change impacts on flood).

- The close proximity in the timing of the cyclone and Auckland flooding was an unfortunate coincidence and unrelated to climate change.

Climate Change Impact by Peril

We evaluate the impact of climate change on a peril based on observations, climate models and our understanding of the physical drivers. In cases where we have a consistent view—a long observational record, high-resolution climate model output and a good understanding of the physical drivers—then we will have high confidence in our assessment. Conversely, there are many reasons why we would have lower confidence, for example, if an observational record is short or unreliable, or if there is disagreement between different climate models.

Here we summarise the climate change impact on floods, bushfires, severe convective storms, tropical cyclones (TCs) and low pressure systems (excluding TCs). Note that climate change does have a significant impact on a wide range of other perils, including drought and heat stress, but these typically have lower insured losses associated with them in Australasia-Oceania.

Climate Change Impacts on Flooding

The impact of climate change on flood is complex. Intense rainfall has a relatively direct link to surface water flooding and therefore the climate change impact is generally well understood. In contrast, the response of riverine flooding to precipitation is dependent on a large number of factors, including soil moisture, temperature, snowmelt and catchment characteristics, and therefore changes are harder to predict and highly regional.

Climate Change Impacts on Fire Weather

Bushfire risk changes are driven primarily by projected trends in temperature and precipitation. However, this peril is unique in that there are significant human factors, including ignition, suppression, mitigation and various levels of built-in property resilience. We focus on the changes to fire weather in a changing climate but caution that sufficiently strong fire-suppression efforts can potentially outweigh increases in fire weather.

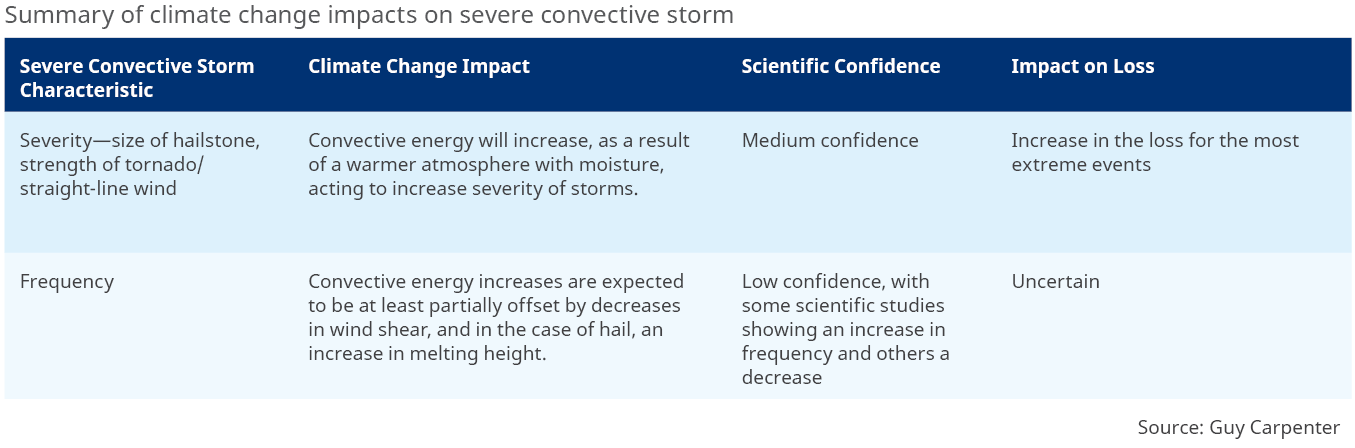

Climate Change Impacts on Severe Convective Storm

Severe convective storms include the sub-perils of hail, tornadoes and straight-line winds. All of these sub-perils need convective energy to develop—a source of moisture and heat at lower levels of the atmosphere. They also require wind shear—a difference in wind at upper and lower levels—to set up a storm of severity sufficient to produce hail or damaging winds. Finally, for hail specifically, the melting level—the height at which water freezes—needs to be sufficiently low for the convective cell to penetrate it and for hail to form. Climate change has a different impact on each of these drivers of severe convective storms, and they are explored below.

Climate Change Impacts on Tropical Cyclones

Climate change affects the frequency, severity and location of TCs in the southeastern Indian and southwestern Pacific oceans, as outlined in the table below. The impacts are wide-ranging, as the energy source of TCs (the ocean), the winds that inhibit their growth (wind shear) and the large-scale circulation pattern that steers them are all affected. There are also implications for the precipitation and coastal flooding associated with TCs, included in the table Summary of climate change impacts on flood.

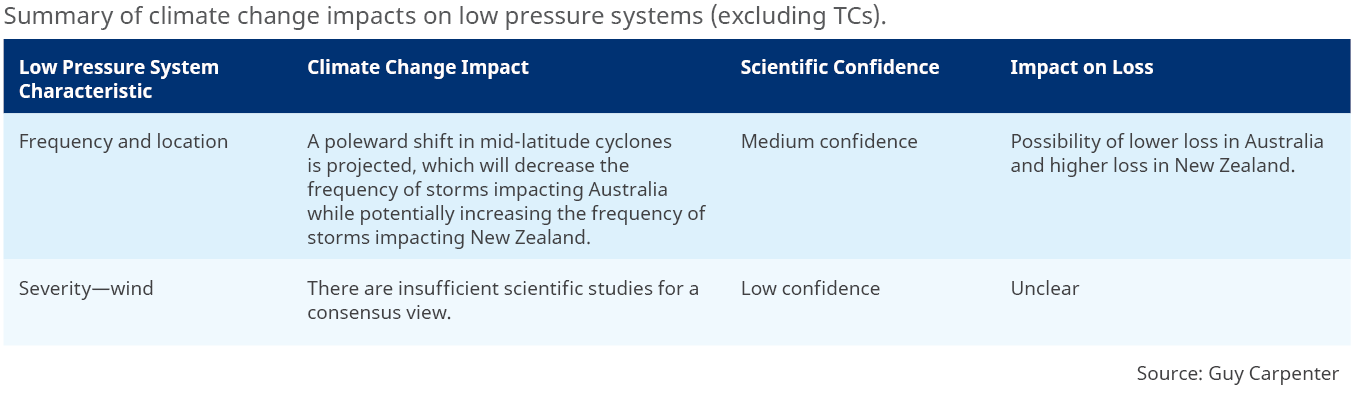

Climate Change Impacts on Low Pressure Systems

Low pressure systems, excluding TCs, include extratropical cyclones and cut-off lows, and are often referred to as east coast lows when they affect southeastern Australia. These systems also affect New Zealand. They can cause flooding, and the climate change impact on this aspect is included in the table Summary of climate change impacts on flood. Strong and damaging winds also can be associated with these systems.

Quantifying your Climate Change Physical Risk

There are a growing number of reasons for quantifying your climate change risk:

- Responding to regulatory requests.

- Representation of risk to third parties, for example credit rating agencies, investors or reinsurers.

- Making a TCFD-aligned climate disclosure.

- Incorporating climate change into risk management, pricing and capital decisions.

The type of risk assessment to carry out will be dependent on the use case. Important questions to consider before making any climate change assessment include the following:

- Is a qualitative or quantitative assessment required?

- What scenarios are of interest? This could be a specific emissions pathway and time horizon, for example RCP-4.5 in 2050, or instead a global warming level scenario, for example 1.5°C.

- Do you require an assessment on whether existing climate change is adequately represented in your current view of risk?

- What form of data is required to embed the climate change assessment in your existing decision-making processes?

Guy Carpenter is helping our clients address these questions and quantify their climate change physical risk through a variety of methods. For the quantification of the risk, Guy Carpenter has developed proprietary tools ranging from underwriting and accumulation layers, to adjustments to third-party catastrophe models and in-house probabilistic models developed for climate change. Furthermore, we have a broad overview of market practices that can help clients benchmark their own activities.

For Australia, we have data layers that enable you to assess your storm surge risk for a range of climate change scenarios. We also have inland flood and tropical cyclone catastrophe model adjustments that provide a fully probabilistic climate change assessment.

Conclusions

An improved scientific understanding of how perils are changing and the fact that an increasing number of regulators are exploring climate-related disclosures means quantifying your climate change risk has never been more important. Doing so may also help avoid unexpected loss from evolving tropical cyclones and flood risk. It is also important to be aware that climate change may not be the most significant driver of changes in loss for your portfolio. Other factors, such as natural variability and inflation, should be properly considered to inform risk management, pricing and capital decisions.