Challenges we must rise to

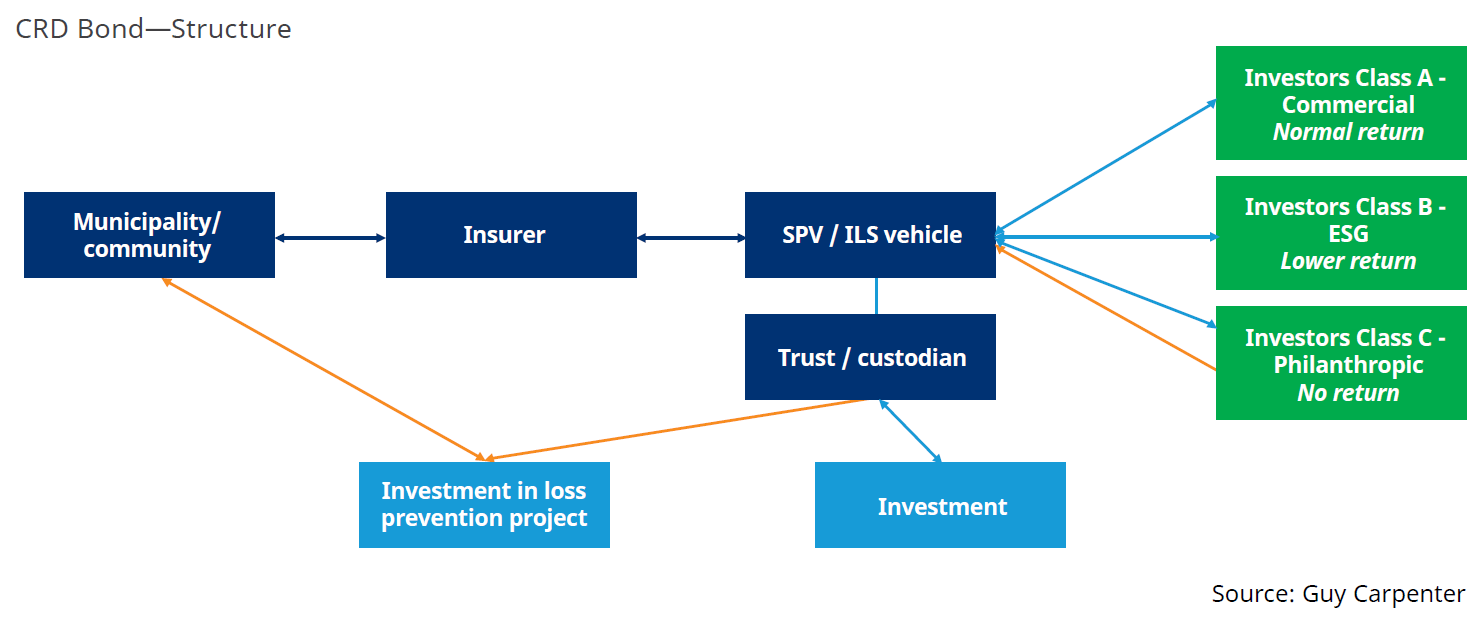

We recognize that the CRD Bond comes with underwriting, modeling, legal and logistical challenges. In fact, we are aware of earlier attempts to launch so-called resilience bonds3 that could not be modeled to scale the savings associated with the risk reduction to the project costs and the time lag associated with the implementation of an infrastructure project. We think that the scale can be improved by community-based insurance.

As research into climate-change mitigation and adaptation measures advances,4 we must also consider local projects that can be identified on science-based evidence and implemented within the terms of the CRD Bond. We also acknowledge that the funding derived from monetizing the risk reduction may not match the full costs of the project.

However, it will be a contribution that could make the difference between the project being financially feasible or unaffordable for the relevant community. In addition, we would hope that there is P and E investor appetite for the CRD Bond as an investment opportunity with clear social and environmental objectives, as well as support from public-private partnerships. As noted above, solutions to the climate crisis and its effects require collaboration at all levels, including from the insurance industry and the financial markets.

We remain convinced that the insurance industry can rise to the challenge and create a sea change in how its role in addressing the climate crisis is perceived. We consider that the CRD Bond is a sustainable solution to combining financial resilience and loss-prevention measures consistent with the principles of equity, sustainable development, co-operation, and the precautionary principle5 that underpins the Paris Agreement.

The CRD Bond has the potential to make an impactful contribution from the insurance industry to the implementation of sustainable and just solutions to the climate crisis, as well as heralding a paradigm shift for climate change insurance and beyond by bringing ”loss prevention” into focus. It is imperative that insurers, governments, investors, philanthropists, and other stakeholders work with the authors to turn that potential into a market reality.