Evolution of Traditional Perils and Increasing Concerns from Aviation and War Risk Exposures

With ongoing aviation challenges, such as maintenance issues and shortage of skilled workers, there are concerns about rising incidents given the rebound in travel post-COVID-19. Coupling these emerging challenges with ongoing armed conflicts, the accident marketplace remains on guard with measured risk appetites. During the 2024 reinsurance renewal cycle, the market continued to focus on exposures through a systemic peril lens.

In this article, we explore how travel numbers are rebounding post COVID-19 and the potential challenges our clients may face going forward. We have sourced conveyance-specific reinsurance covers (trains, planes and automobiles) for a number of clients, which typically sit below or adjust the retention of the primary catastrophe layers.

Key takeaways on the reinsurance market identified by Guy Carpenter from the 2024 accident catastrophe renewals

Accident & health reinsurers’ appetite for systemic perils continues to be suppressed by recent events. Lloyd’s defines systemic risk as a low-likelihood, high-impact risk that affects either a systemically important global enterprise or multiple sectors, societies or national economies. These risks can be global in impact, as seen in recent years with COVID-19 and geopolitical conflicts in Ukraine and Gaza.

In prior years, accident and health reinsurers’ attention have been drawn to protecting against natural disasters, terrorism and—more recently—pandemic risk. Over the past 2 years reinsurers have expressed concerns surrounding the escalation of war due to the conflicts in Ukraine and Gaza. This concern revolves around the potential for increased violence, loss of life, destabilization of regions and broader geopolitical implications, which could lead to further conflict.

Capacity

Total core treaty capacity levels remained consistent, at USD 700 million.

Facultative reinsurance and alternative capital can be used to source capacity in excess of USD 700 million.

- 4 new market entrants at January 2024 (2 in the UK and 2 in the US).

- Conservative approach to deploying maximum line sizes and managing aggregates.

- 2 markets exited in the class in 2023 (1 London, 1 Bermuda).

Price

- Hardening rating environment, but stable for loss-free renewals.

- Interest rate and inflation environments combine to put pressures on cost of capital.

- Pricing ranges have shifted -/+ 10% based on program experience and profile which can be split into three categories:

- Loss-free and non-hazardous territories.

- Loss free including in high-risk war countries.

- Loss-impacted programs.

- For accident & health, capital market pricing is precarious given the returns in largely risk-free gilt and bond markets.

Terms and Conditions

- Consolidation of event and exclusion definitions (i.e., event duration period, loss date specified at time of loss or date of notice, and territory parameters).

- Focus on hours and radius clause in addition to a strong focus on war language.

- Retrocessional market driving war and communicable disease terms and conditions:

- Territorial war exclusions apply where known exposures are in high-risk territories.

- Epidemic/pandemic or communicable disease coverage limited for travel-inclusive covers.

- Russia, Ukraine, and Belarus continue to be monitored, as well as Israel and Gaza.

- Reinsurance solutions available with additional premium or as a carve-out via treaty or facultative placements.

- Special termination clauses are under review in contracts from Lloyd’s Syndicates, due to Lloyd’s now being recognized as a “reciprocal reinsurer” in the US.

An Eye on the Sky During the Travel Industry Rebound

It has been 15 years since the last major commercial airline crash in the US.1 This year we have seen major aviation incidents that have caused safety procedures to be revisited and planes to be grounded.

The talent shortage pressuring the aviation industry is a developing concern in increasing flight incidents.

Oliver Wyman’s report, Not Enough Aviation Mechanics, delves into the challenges the aviation industry is facing and how it can address them. The authors surveyed a group of companies in the maintenance, repair and overhaul (MRO) segment of aviation, and anticipate a shortfall of somewhere between 12,000 and 18,000 aviation maintenance workers. This imbalance of supply and demand is expected to persist and potentially worsen over the next 10 years.4

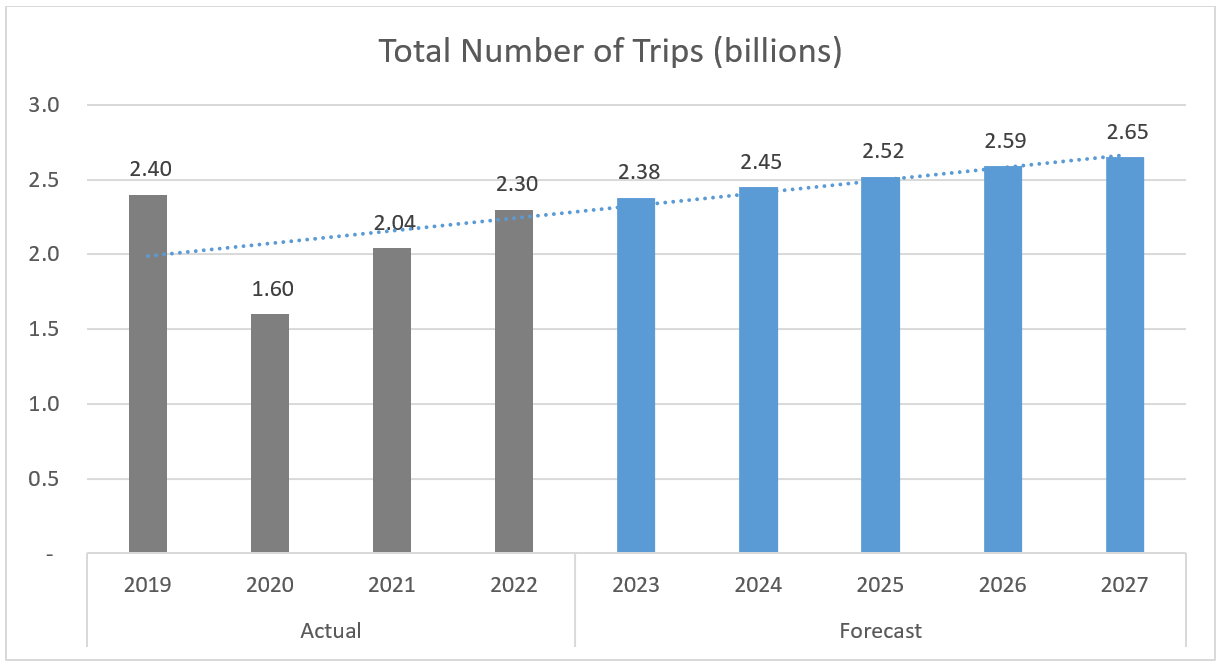

According to the US Travel Association, “travel appetite started the year on a softer note, but overall growth continued.” While hotel room bookings are down, group room bookings are up 9% compared to 2023.5 Forecasts for 2024 exceed 2019 volume, with steady growth predicted in subsequent years:

How Guy Carpenter Can Help

Our team at Guy Carpenter can help our clients tailor solutions to effectively and efficiently match the right capital with your evolving risk profile. We can work together to address these emerging concerns in the travel space by securing reinsurance support through:

- Traditional proportional or non-proportional treaty structures.

- Conveyance specific treaty reinsurance.

- Facultative carve-out reinsurance.

- Cyber-specific reinsurance.

At Guy Carpenter, our unsurpassed market presence—coupled with our reinsurance broking expertise, capital solutions, strategic advisory services and industry-leading analytics—equips clients with innovative solutions and leverages to enable the best terms and conditions the reinsurance market has to offer for accident and catastrophe risks.

We take a holistic approach to evaluating challenges and can help you incorporate best practices and emerging trends into your risk management objectives. Our leading analytics empowers clients to make informed decisions. We encourage you to reach out to the Guy Carpenter representatives below with any questions or to learn more about Guy Carpenter’s insights and solutions in the accident market.

Contacts

| Kathleen Russo | Zara Ulusoy |

| Senior Vice President | Senior Vice President |

| kathleen.russo@guycarp.com | zara.ulusoy@guycarp.com |

| Adrienne Johnson | |

| Vice President | |

| adrienne.johnson@guycarp.com |

Sources

- Last fatal US airline crash was a decade ago. Here’s what’s changed (cnbc.com)

- The Alaska Air flight was terrifying. It could have been so much worse | CNN Business)

- Japan Airlines jet bursts into flames after collision with earthquake relief plane at Tokyo Haneda airport | CNN)

- How To Overcome The Impending Shortage Of Aviation Mechanics (oliverwyman.com)

- The Latest Travel Data (2024-03-04)| U.S. Travel Association (ustravel.org).

- Runway Incursion Totals by quarter FY2024 vs. FY2023 (faa.gov) FAA Statements on Aviation Accidents and Incidents | Federal Aviation Administration.

- FAA says future United projects ‘may be delayed’ due to increased oversight | CNN Business

- Media Reports on Updated Oliver Wyman Pilot Shortage Data (The airline industry has put a dent in the pilot shortage: Travel Weekly)

- Survey: LaGuardia Airport ranked best in its class (ny1.com)

- Generative AI Travel Tools Drive Loyalty Value For Travelers (oliverwyman.com)