The 2016 Central Italy earthquakes resulted in losses estimated to be as high as EUR 29 billion,[1] and in 2009, the L’Aquila earthquake caused losses in the order of EUR 10 billion[2]. More recently, in May 2023, strong and persistent rain caused flooding in Emilia, resulting in around EUR 9 billion[3] of losses.

However, in all 3 cases, only a small fraction of the overall losses were insured. For example, the insured loss from the Emilia flooding is estimated at EUR 495 million—only 5.5% of the total.

This figure is is fairly representative of the residential insurance penetration for natural catastrophe (Nat Cat) policies in Italy. The Association of the National Insurers (ANIA) estimates only around 5.9% of all houses in Italy have an earthquake or flood policy.4

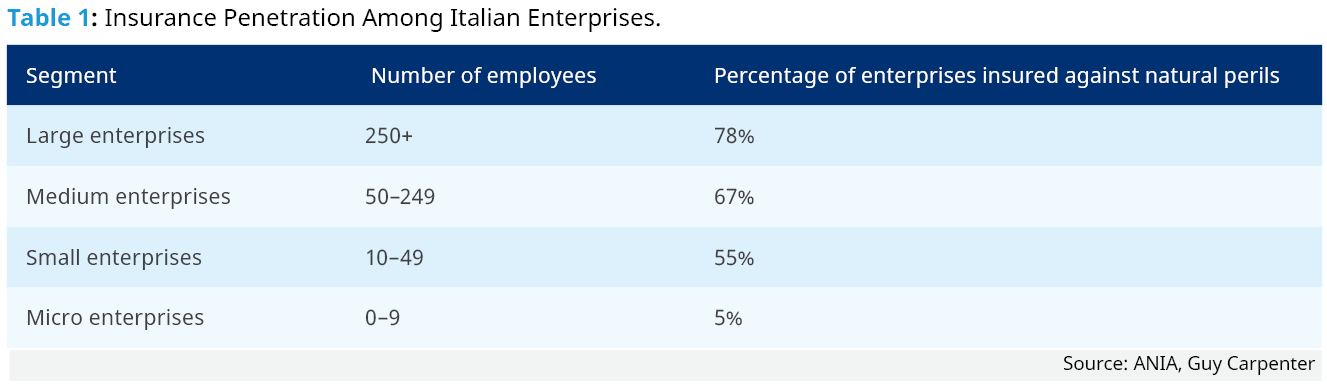

The landscape looks more fragmented when analyzing the insurance penetration of commercial and industrial enterprises. The largest companies are generally equipped with risk management teams, and most of them purchase insurance. Yet, smaller companies tend not to get the same level of coverage, and the insurance penetration rate among micro enterprises is even lower–at a level similar to that of the residential sector.5

The situation highlighted above, with a wide protection gap for residential and small enterprises, is due to a range of factors, including the expectation that after a Nat Cat event the State will step in and pay the bill, and a poor insurance culture in Italy.

The Italian government is introducing a new law as a first step to gradually change the factors that have led to this significant protection gap, with further details on this new scheme described below.

The new Nat Cat scheme

The legislation passed in December 2023 sets the cornerstones of the new Nat Cat scheme.

Enterprises registered in the Italian Businesses Register (Registro delle Imprese) must purchase a policy covering earthquake, floods and landslides. The State will consider the fulfillment of such obligation when granting contributions and subsidies to the enterprises, including those contributions following a Nat Cat event.

In parallel, insurers will have the obligation to offer insurance (obbligo a contrarre) and risk a minimum fine of EUR 100,000 if they fail to do so. Policies must cover direct damage, including damage to land, and may include a deductible of up to 15% of the loss (scoperto).

Insurers will have the option to cede to SACE, a state-owned insurer, up to 50%6 of their Nat Cat book that falls within the scheme. SACE is equipped with a fund of EUR 5 billion, guaranteed by the State, and will be available for insurers in 2024, 2025 and 2026. During the second and third year, the SACE fund will be topped up by the unused funds of the previous years.

Future development and strategic options

There are many elements to clarify in the coming months through the implementation of decrees and regulations. Some of the key considerations going forward will be the sanctioning system, policy limits and SACE terms and conditions, but also the possibility to freeze the obligation for single insurers in case of excessive demand.

The introduction of the new Nat Cat law in Italy empowers the insurance industry with the opportunity to establish a pool. In contrast to other nations facing comparable risks, where governments have directly established pools without involving the private market in their development, Italy's law grants the industry the possibility to take charge of this initiative.

Although there are some hurdles to overcome in the implementation, the pool represents the best strategic option for the industry. The SACE fund will only be available until 2026, leaving the market without a potential source of capacity for 2027 and beyond. Furthermore, a future logical step for the Italian government may be to extend the requirement for Nat Cat cover to the residential sector as well, achieving (theoretical) full coverage in Italy and enhancing economic resilience in the wake of natural catastrophes, but also requiring another stretch in terms of insurance capacity.

Contacts

| Vincenzo Cacia | Andrea Folegani |

| CEO, Italy | Deputy CEO, Italy |

| vincenzo.cacia@guycarp.com | andrea.folegani@guycarp.com |

| Eugenio Dissegna |

| Broker, Guy Carpenter's Milan office |

| eugenio.dissegna@guycarp.com |

Footnotes

- ANSA: https://www.ansa.it/sisma_ricostruzione/notizie/2023/01/10/terremoto-sisma-2016-danni-per-265-miliardi-saliranno-a-28-29_ed813ee8-fd6a-409e-a57c-c8db86fb252c.html

- Ilsole24ore: https://www.ilsole24ore.com/art/quindici-anni-fa-terremoto-dell-aquila-che-punto-e-ricostruzione-superbonus-tetto-70-milioni-AFqFwYMD

- PERILS: https://www.perils.org/news/eur-495m-perils-releases-final-loss-estimate-for-the-emilia-romagna-floods-of-may-2023

- ANIA

- ANIA and elaboration Guy Carpenter

- The law speaks of “50% of the claims”; this is interpreted here as a “50% quota-share.”