Fully Integrated Team and Services

175+ MGA deals controlled, $3B+ annual gross written premium placed into market

We assist MGA and program carrier clients with a wide variety of program-related information and access to specialty services, including:

- Program leads

- Assistance with the carrier selection process

- Participation as an advisor in client meetings and prospect visits

- Specialty program issuing carrier intelligence

- White papers

- Access to specialty program service providers

- Specialty program reinsurance market intelligence

- Input on specialty program structures

- Banking/investment/merger & acquisition services

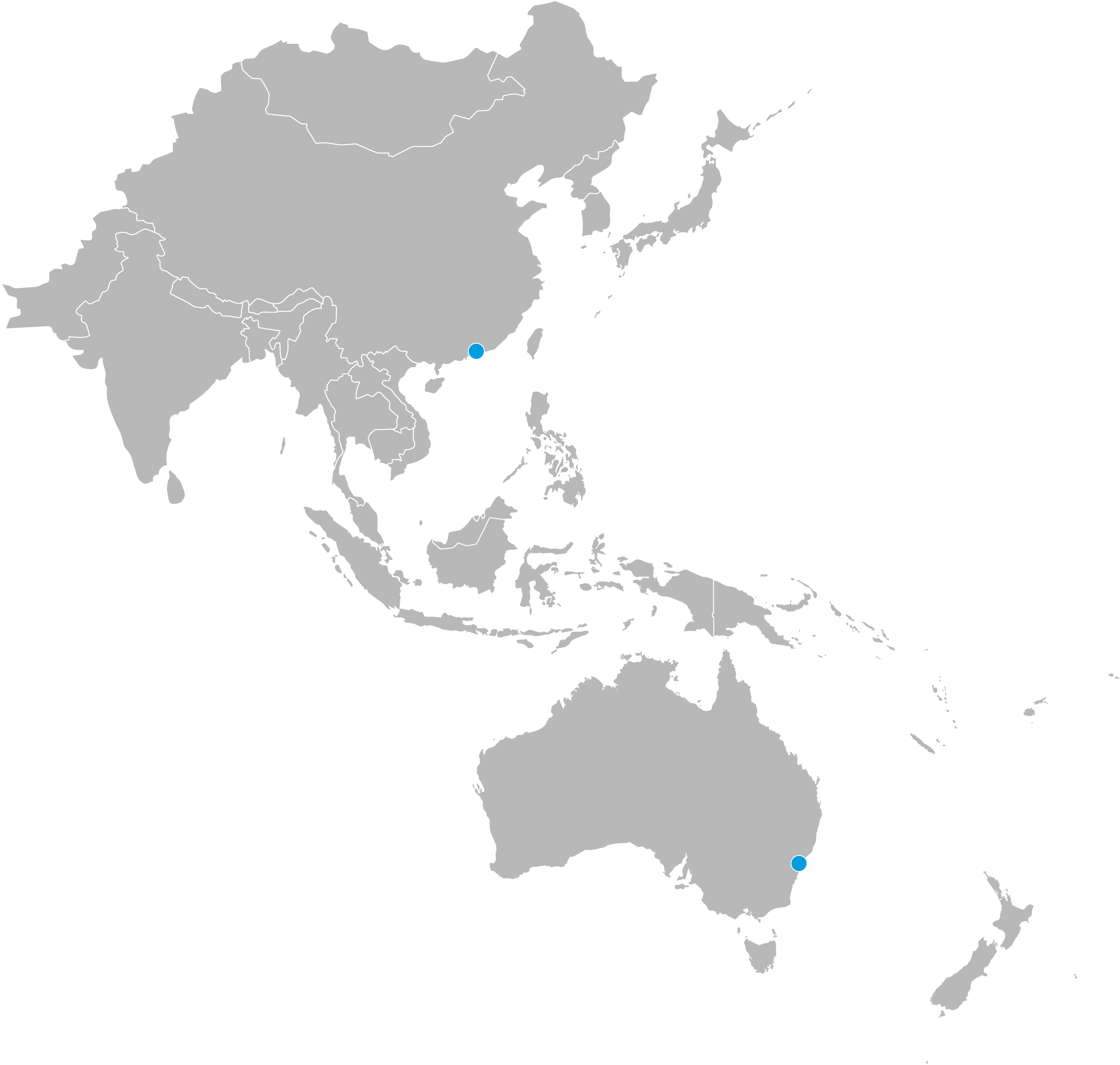

- Guy Carpenter’s global MGA marketplace view

- Corporate reinsurance solutions

GC Access is supported by a dedicated team of program brokers, contract specialists, modelers and actuaries.

We provide fully integrated services across business planning, program carrier selection, capital advisory and modeling support. GC Access also introduces numerous program-specific proprietary tools, and accesses Guy Carpenter’s global reach to deliver best-in-class client solutions.