Matthew Day, Senior Vice President, Guy Carpenter Strategic Advisory and Ross Milburn, Managing Director, GC Securities*, a division of MMC Securities (Europe) Ltd., which is authorized and regulated by the Financial Conduct Authority

Contact

In recent months a number of market commentators have opined on the merits of proportional reinsurance versus subordinated debt (sub debt), some favoring reinsurance solutions and some favoring sub debt, but generally finding results in line with the products their companies offered. Guy Carpenter feels reinsurance or sub debt alone is unlikely to provide the best solution to meet solvency capital requirements. Instead, a blended approach should be considered.

At Guy Carpenter, we have taken a more holistic approach to our analysis of this topic, focusing on how bespoke solutions for each client can be more effective. By being agnostic as to the solution, using an optimized mix of proportional, excess of loss, catastrophe and retroactive reinsurance - combined with the strategic use of sub debt - clients can achieve their aims of mitigating insurance risk, optimizing returns and managing their solvency capital requirement (SCR) while retaining the flexibility to make strategic decisions across the cycle.

Reducing the SCR

One of the benefits of considering a blended approach is the ability to achieve a targeted SCR coverage level through a combination of solutions that:

- I. Maximizes the capital benefit cost efficiently

- II. Ensures that the potential loss exposures are managed within the company's risk appetite and

- III. Avoids any reputational risk associated with some large reinsurance or public market sub debt transactions.

The objective is always to ensure that the company's risk management aims are satisfied in conjunction with achieving the optimal level of capital.

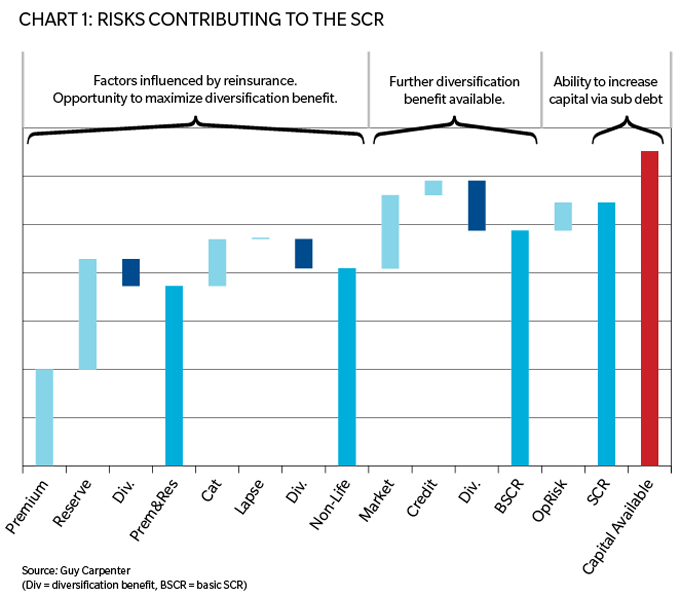

As illustrated in Chart 1, the SCR comprises a number of components including premium risk (future insurance risk); reserve risk (existing insurance risk); catastrophe risk; market risk, credit risk and operational risk.

While other commentators have focused on single large proportional reinsurance transactions to manage premium risk within the SCR, we feel this fails to capture an insurer's ability to maximize the diversification benefit optimizing the three insurance risk components by structuring a reinsurance program covering risk, catastrophe and reserve deterioration protection.

A company currently faced with a disproportionate level of risk in any one of the three components can successfully mitigate this through a blended solution, helping to achieve capital optimization through targeted risk management rather than the sometimes crude solution of a large quota-share or sub debt solution.

By addressing the underlying drivers of the capital requirement, management is able to demonstrate a greater level of understanding of its risk profile and will be better placed to communicate its capital management approach to stakeholders. Generally, each of the component parts of a blended solution is based on a commonly used product so the execution risk is not unduly high.

Diversification benefit is also available between the insurance and non-insurance risks as the relative returns from underwriting and investments fluctuate over time. A suite of reinsurance products allows greater opportunity to shift risk capital to and from either side of the divide and manage this diversification in light of potential returns. This article appeared in Insurance ERM

Click here to register to receive e-mail updates >>

*Securities or investments, as applicable, are offered in the United States through GC Securities, a division of MMC Securities Corp., a US registered broker-dealer and member FINRA/NFA/SIPC. Main Office: 1166 Avenue of the Americas, New York, NY 10036. Phone: (212) 345-5000. Securities or investments, as applicable, are offered in the European Union by GC Securities, a division of MMC Securities (Europe) Ltd. (MMCSEL), which is authorized and regulated by the Financial Conduct Authority, main office 25 The North Colonnade, Canary Wharf, London E14 5HS. Reinsurance products are placed through qualified affiliates of Guy Carpenter & Company, LLC. MMC Securities Corp., MMC Securities (Europe) Ltd. and Guy Carpenter & Company, LLC are affiliates owned by Marsh & McLennan Companies. This communication is not intended as an offer to sell or a solicitation of any offer to buy any security, financial instrument, reinsurance or insurance product. **GC Analytics is a registered mark with the U.S. Patent and Trademark Office.