Matthew Day, Senior Vice President, Guy Carpenter Strategic Advisory and Ross Milburn, Managing Director, GC Securities*, a division of MMC Securities (Europe) Ltd., which is authorized and regulated by the Financial Conduct Authority

Increasing the Permanent Capital Available

Sub debt is an additional part of the capital tool kit available to insurers and can often be used to greater effect as part of a tailored solution than in isolation. In conjunction with a risk and/or capital management-based approach to the mitigation of each of the solvency capital requirement (SCR) components, management may consider issuing sub debt to provide growth capital (organic and through acquisition) as well as make a longer term contribution to SCR coverage.

The multi-year nature of sub debt provides attractions to issuers, allowing greater certainty in the long-term strategic business planning process. As a debt instrument it provides a company with a tax efficient alternative to equity without diluting existing shareholders. Sub debt is a capital instrument that ranks junior to all liabilities, but ahead of ordinary equity, meaning it is designed to be loss absorbing only in extreme circumstances - to protect policyholders when a company is no longer a going concern and equity has been fully eroded.

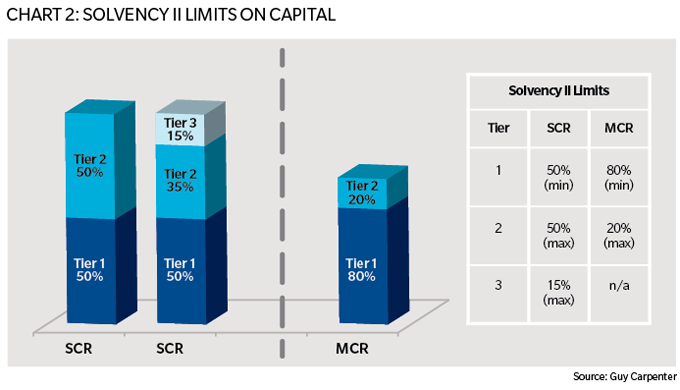

The use of sub debt for regulatory (and rating) capital purposes is limited to a maximum percentage of the SCR. There are also subordinate limits depending on the tiering of the sub debt according to the duration and features of the instrument being issued. In addition, regulatory criteria limit the use of sub debt relative to the Minimum Capital Requirement (MCR), although this should only be a factor in times of capital distress. These limits are shown in Chart 2.

In the chart above, Tier 1 represents the "highest quality" instruments that are permanently available and most subordinated. Typically this would include share capital and perpetual debt. Long-dated subordinated bonds and letters of credit typically fall into Tier 2, while all other credit is covered in Tier 3.

Benefits of a Blended Approach

While large capital raises (via debt or equity) and large quota shares and reserve deals are increasingly commonplace and part of the suite of capital optimization solutions, they still may have the ability to raise eyebrows as equity, credit and rating analysts question management's rationale.

Under the blended approach a series of smaller deals may not create the same level of negative interest from stakeholders. The target is always to reduce the possible risk of increased costs due to multiple deals through deal coordination, selective marketing and broker placement expertise. A relatively small private placement of sub debt should be an efficient and low profile element of a blended solution that does not create public disclosure requirements or place an undue strain on management's resources.

There are a number of other potential restrictions on single, large deals, including fluctuations in reinsurance and debt market capacity and pricing; rating capital requirements that limit the amount of sub debt that attracts credit, as well as rating caps relating to reinsurance over-dependence.

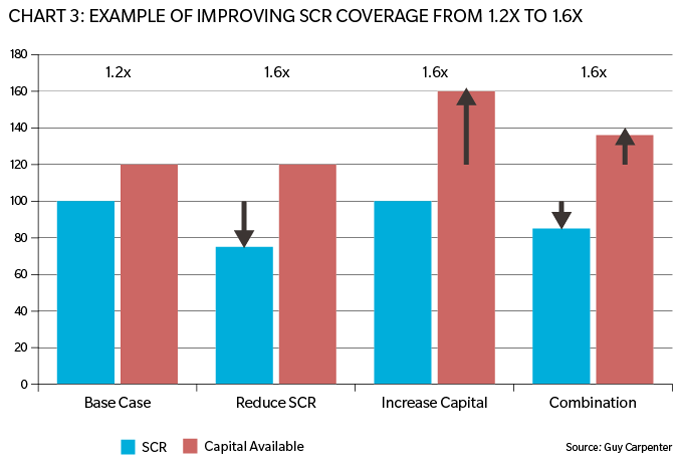

Like any other ratio, SCR coverage can be changed by altering either the numerator or the denominator or a combination of the two. In practice, changing both the available capital and the SCR will normally be more efficient than just one or the other. This is shown in Chart 3 under three scenarios: reducing the SCR through reinsurance; increasing the available capital via an issue of sub debt or through a combination of the two - all of which increase SCR coverage from 1.2 times in the base case to 1.6 times in each of the scenarios.

While at first glance it appears that reducing the SCR would be the easier option due to the need to raise more capital (a difference of 40 points between Reduce SCR and Increase Capital in Chart 3) than the equivalent reduction in SCR (25 points under Reduce SCR), this may not always be the case. Diversification may be unwound by some reinsurance solutions and the size of the cession can be a multiple of the SCR reduction.

While an approach involving a number of transactions may have greater execution risk, this needs to be balanced against the risks associated with large single product solutions as discussed above. Each company's situation is unique and it is essential to consider all options and combined solutions in order to achieve the optimal result.

This article appeared in Insurance ERM

*Securities or investments, as applicable, are offered in the United States through GC Securities, a division of MMC Securities Corp., a US registered broker-dealer and member FINRA/NFA/SIPC. Main Office: 1166 Avenue of the Americas, New York, NY 10036. Phone: (212) 345-5000. Securities or investments, as applicable, are offered in the European Union by GC Securities, a division of MMC Securities (Europe) Ltd. (MMCSEL), which is authorized and regulated by the Financial Conduct Authority, main office 25 The North Colonnade, Canary Wharf, London E14 5HS. Reinsurance products are placed through qualified affiliates of Guy Carpenter & Company, LLC. MMC Securities Corp., MMC Securities (Europe) Ltd. and Guy Carpenter & Company, LLC are affiliates owned by Marsh & McLennan Companies. This communication is not intended as an offer to sell or a solicitation of any offer to buy any security, financial instrument, reinsurance or insurance product. **GC Analytics is a registered mark with the U.S. Patent and Trademark Office.