Matthew Day, Senior Vice President, Guy Carpenter Strategic Advisory and Ross Milburn, Managing Director, GC Securities*, a division of MMC Securities (Europe) Ltd., which is authorized and regulated by the Financial Conduct Authority

What About Volatility?

Insurers understand volatility in respect of their insurance and investment risk and reinsurance can play a significant role in controlling this. However, another form of volatility exists in respect of the pricing and availability of reinsurance and sub debt. To counter this clients are encouraged to consider multi-year reinsurance transactions, retroactive solutions and to explore sub debt issuance that by nature is long term. By staggering the end-dates of different transactions, a natural hedge against rising rates on line and debt market spreads can be created.

This form of market volatility will be most pronounced when a client has a dependency on a single source of capital - either reinsurance or sub debt.

Approaching the Optimal Solution

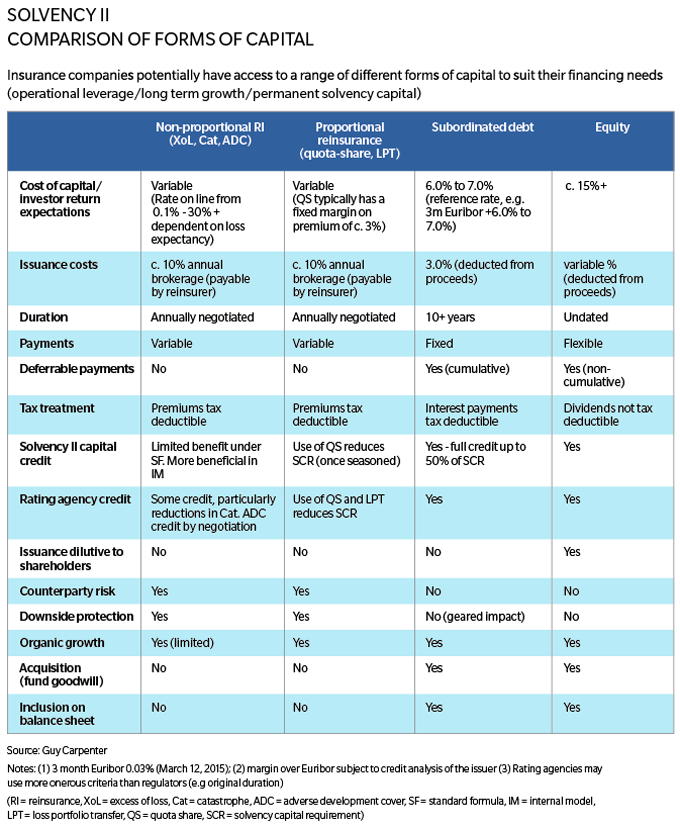

As the table below shows, both reinsurance and sub debt have advantages and disadvantages when used as capital management tools. Guy Carpenter's intimate knowledge of both products and the ability to transact strategy-aligned solutions allows our clients to achieve their capital needs in the most efficient and flexible manner.

By analyzing the solvency capital requirement (SCR) components and available capital in conjunction with management's strategic aims, a solution can be tailored that not only provides optimal risk mitigation and enhances shareholder returns, but also achieves the targeted SCR in the most efficient manner. This includes ensuring that any reputational risk is managed and that the solutions proposed support the other constraints placed upon the company by rating agencies, overseas regulators and other external stakeholders.

This article appeared in Insurance ERM.

*Securities or investments, as applicable, are offered in the United States through GC Securities, a division of MMC Securities Corp., a US registered broker-dealer and member FINRA/NFA/SIPC. Main Office: 1166 Avenue of the Americas, New York, NY 10036. Phone: (212) 345-5000. Securities or investments, as applicable, are offered in the European Union by GC Securities, a division of MMC Securities (Europe) Ltd. (MMCSEL), which is authorized and regulated by the Financial Conduct Authority, main office 25 The North Colonnade, Canary Wharf, London E14 5HS. Reinsurance products are placed through qualified affiliates of Guy Carpenter & Company, LLC. MMC Securities Corp., MMC Securities (Europe) Ltd. and Guy Carpenter & Company, LLC are affiliates owned by Marsh & McLennan Companies. This communication is not intended as an offer to sell or a solicitation of any offer to buy any security, financial instrument, reinsurance or insurance product. **GC Analytics is a registered mark with the U.S. Patent and Trademark Office.